Contributed by Bianca Fernet, a Brave American economist in Buenos Aires, Argentina. Her blog Not Paris dives into financial and economic topics in Argentina and occasionally other countries in South America....

So after my post on Argentina and Dual Exchange Rates, I received quite a few questions. I decided it will be worth writing a handful of posts to catch up those of you who are not lucky enough to live in this fine country where major roads are cut off by protestors banging pots and pans on a daily basis, and restaurant menus are heavy with price stickers piled on top of each other.

The most important economic fundamentals in Argentina that I will take one post each reviewing are as follows:

- Inflation

- Import and export restrictions

- Currency controls

- Government

These topics are quite obviously interconnected, but I think a quick explanation of each will make the rest of my posts more enjoyable.

Inflation

When I first moved to Argentina, I would joke endlessly about the little old ladies in line at the supermarket who would issue a constant stream of complaints regarding the price of meat. To me, this seemed ludicrous. The price of meat was low compared to what I was used to in the states. Over time however, these abuelas have come to represent for me a transformation.

Inflation is nothing more than a rise in price levels, and it is a normal trend to observe over time in most developed economies following the end of the gold standard. Find any grandparent and ask them about the price of a coke or a movie ticket back in the day. You’ll quickly realize that inflation is not limited to under-developed nations ruled by despots. At the other end of the spectrum, you might recall from history famous cases of hyperinflation; for example, post WWI Germany in 1923, where prices rose per 3,250,000 % per month (doubling every two days) and citizens brought wheelbarrows of Marks to make their purchases.

What most people fail to recognize is that between the slow increase in the price of a soda and the wheelbarrow full of cash exists the possibility of sustained, almost unbearably high inflation.

Independent reports clock Argentina’s annual real inflation at between 20 and 30 percent. INDEC, the government statistics agency, regularly and vigorously reports figures around 9 percent. Since 2007, the government has fired and closed down individuals and organizations that deign to report differently, chastising them as anti-Argentina and puppets of international governments hell-bent on undermining Argentine growth and progress. For more on that, check out the image to the right this article, both from the economist.

Since 1950, Argentina has had five different currencies lasting from two years to 20 years. In every case, inflation eroded the value of the currency until it was devalued and then replaced. In 2001, Argentina suffered a massive financial crisis when the government froze bank accounts and devalued the pesos from 1:1 with the US Dollar to 4:1, effectively reducing the wealth held by Argentines by 75% overnight in what is known as the Corralito (small corral). Fast forward to today and you find a people that are mistrustful of banks, mistrustful of their currency, and inclined to stash physical US Dollars in safe deposit boxes, under mattresses, and wherever else wealth can be stored out of reach of the government. But holding dollars does not protect you from inflation.

Since 1950, Argentina has had five different currencies lasting from two years to 20 years. In every case, inflation eroded the value of the currency until it was devalued and then replaced. In 2001, Argentina suffered a massive financial crisis when the government froze bank accounts and devalued the pesos from 1:1 with the US Dollar to 4:1, effectively reducing the wealth held by Argentines by 75% overnight in what is known as the Corralito (small corral). Fast forward to today and you find a people that are mistrustful of banks, mistrustful of their currency, and inclined to stash physical US Dollars in safe deposit boxes, under mattresses, and wherever else wealth can be stored out of reach of the government. But holding dollars does not protect you from inflation.

This inflation exists in real (dollar) amounts, meaning the price increases are not offset by a devaluation of the peso. Find someone who visited Buenos Aires in 2004 and they will regale you with tales of living like a king, feasting on steak and wine in five star restaurants, and bringing home finely crafted leather goods for a fraction of the price in the States. Fast forward to 2012 and you’ll more likely hear tell of hotel and meal prices pushing those in New York City, and of shoddily constructed jackets and shoes that promptly fall to pieces, purchased for double what they would cost at Bloomingdale’s.

Now imagine that you are a middle-class Argentine. If you’re lucky, your wages increase annually according to the 9% figure, while your expenses, from rent to food to clothing, increase about 25 percent. Apartment and home rental contracts are available for two years at a time, with a 20 percent increase the second year. Put most simply, you get to enjoy a constant and steady erosion of your ability to provide for yourself and for your family and with that the constant stress of feeling insecure and powerless to maintain a standard of living.

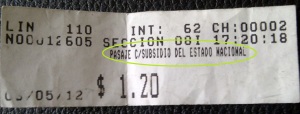

The government has in place a complex and immense system of subsidies designed to allow citizens to maintain a certain level of well-being. Transportation (buses, trains, and airlines), electricity, energy, fuel, and water industries are highly subsidized by the federal government, in addition to some food staples including sugar, sunflower oil, milk, wheat, corn, and soy. Trade barriers, to be addressed next week, act as effective price controls in these and other industries.

Affordable food – nice, right? Except that inflation is caused and made worse by the government printing more and more money to cover expenses that it simply can’t afford. Over the past few months, the government has been forced to cut subsidies in transportation, electricity, and fuel to stay afloat, a trend that I expect to continue.

I will touch on inflation in more detail in future posts. To read up on it for yourself, I highly recommend the previously mentioned article in The Economist, as well as this one, which provide a much more technical analysis than I have provided here.

Remember my abuelas and their meat price complaints? Last week I was in the supermarket to purchase a sausage to cook for breakfast. Two years ago it would have cost me 2 pesos (roughly 40 cents). The butcher rung me up and informed be the price was 5 pesos. I gave him a look of disbelief and turned to complain loudly to whoever was within earshot. At that point a second butcher walked by and asked me in all seriousness, “Are you from here?”

Cross-posted from Bianca Fernet's blog Not Paris...

While it is true that the inflation rate and the meltdown made prices in Argentina go up, it is still cheaper to go there than any other European country and I could say Southsmerican too. The Buenos Aires temporary rent is very affordable and because of the large amounts of tourists arrivals the offer for apartments has increased and the prices went down. I love the fact that a country that is so beautiful and culturally important is so tourist friendly!

ReplyDelete