Despite

the efforts to save energy a strong scenario for near future is that

the

quantity of gas needed in EU region will remain same as today if not

bigger. sources of gas are widely known the essential question is

how the gas is arriving to European markets. Environmental and

technical aspects can be handled as well economical ones; the real battlefield

is (geo) political and it’s much more effective than energy issue itself.

Despite

the efforts to save energy a strong scenario for near future is that

the

quantity of gas needed in EU region will remain same as today if not

bigger. sources of gas are widely known the essential question is

how the gas is arriving to European markets. Environmental and

technical aspects can be handled as well economical ones; the real battlefield

is (geo) political and it’s much more effective than energy issue itself.

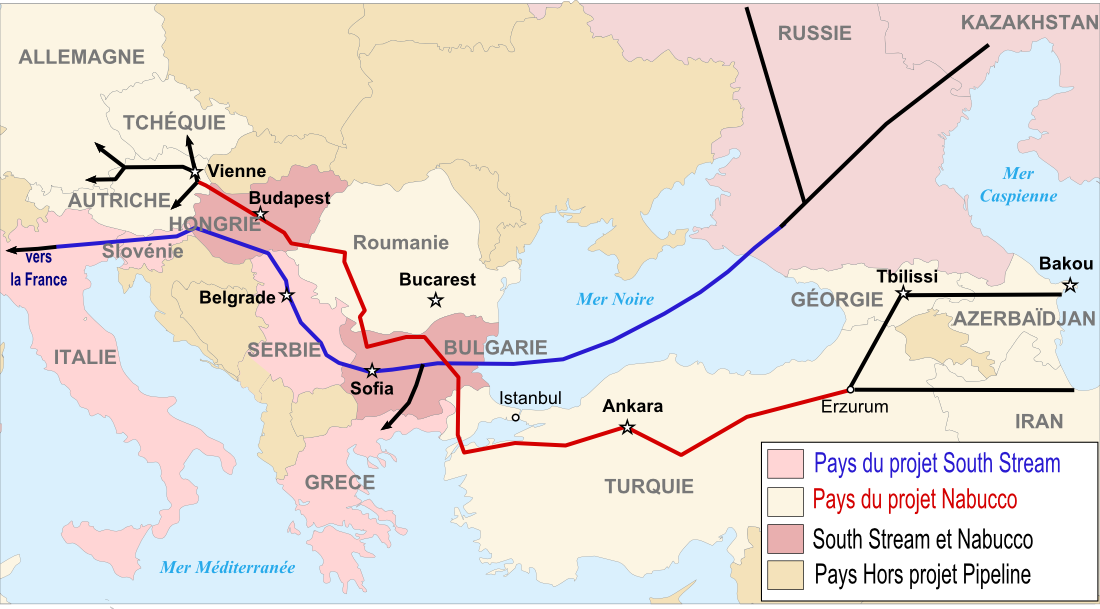

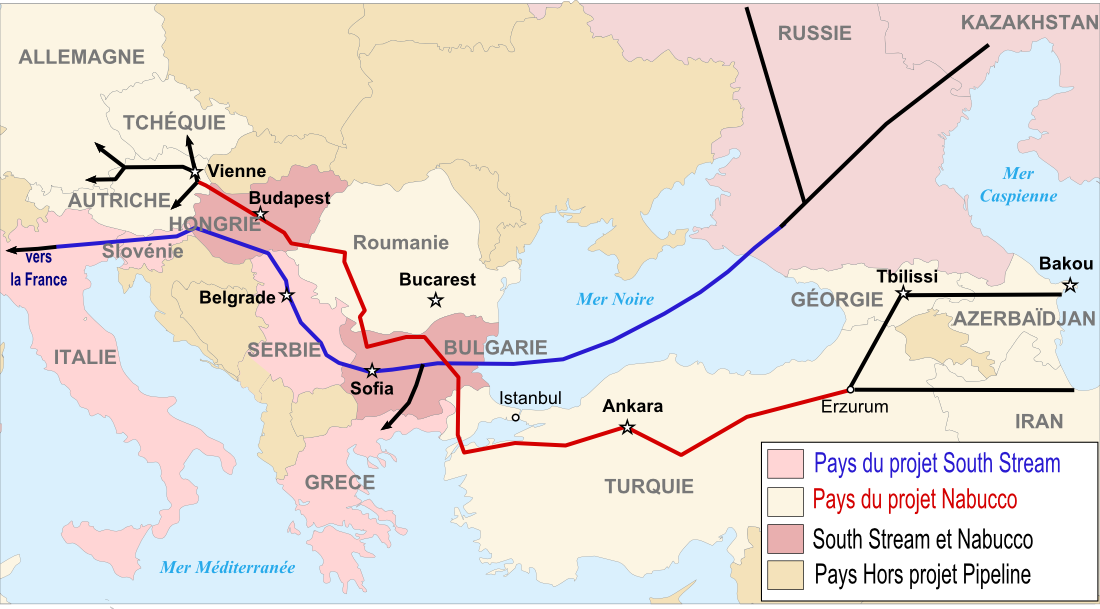

In

today’s Europe

the core of energy war is the struggle between South Stream and Nabucco pipe

lines, which also is one of the most divisive issue inside EU. The

Brussels bureaucracy favour the Nabucco project,

a transit route bypassing both Russia and Ukraine, while a part of EU member states, EU

energy giants and gas producers are favouring Russia’s South

Stream.

Latest

developments

EU,

Russia as well companies interested

about gas business have all activated when decisions are needed to define the

final route of gas to European markets.

a)

EU

The

common factor with both pipelines is that they are eliminating

Ukraine’s transit monopoly.

Publicly EU has probably due political motives planned update

Ukraine’s gas pipeline

network like during The International Investment Conference on March 23rd 2009

in Brussels.

Russia has not been invited

to discuss the terms of gas supplies to Europe via Ukraine's gas pipeline network for three years

but Ukraine is hoping part of requested

$5.5 bn modernization costs from EU in name of EU energy security. Gas buyers

and transit operators may have their views, but the question still remains what

they can buy and on which terms. EU bureaucrats are making a fatal

miscalculation if they are building energy infrastructure without source of

energy itself.

The EU

Commission has included the Nabucco pipeline in its list of priority

projects, despite pressure from Germany and Italy. But the

EU cut its budget funding of the project by 20% getting some 200 million euros

for first stage of the project.Nabucco is likely to rely heavily on subsidies

from the EU. Several member countries questioned the economics of the

project.

The

European Union and Turkey

gave fresh political impetus on 8thMay 2009 in Prague to the Nabucco pipeline project, although key

Central Asian gas suppliers held off on

pledging their support. But it also needs gas, which may be a problem as

Kazakhstan,

Uzbekistan and

Turkmenistan refused to sign

the final declaration in Prague, unlike two other

suppliers -- Azerbaijan and

Egypt -- and two key transit

nations -- Turkey and

Georgia. But Mr Gul also made clear

he expected some progress on Turkey's stalled EU membership

talks. Earlier Turkey’s premier, in a rare visit to Brussels on January 19, tested Europe’s reaction, saying that he will review his support

for Nabucco if the Energy Chapter of its EU accession talks is blocked. “If we

are faced with a situation where the energy chapter is blocked, we would of

course review our position,” he said. (Neweurope 26 January

2009)The Declaration of Southern Corridor Summit here

.

b)

Russia

Russia has

floated plans for a new global treaty on trade in fossil and nuclear fuel in an

attempt to consign to history an earlier pact, the 1991 Energy Charter Treaty.

Russian President Dmitry Medvedev unveiled the project during his state visit in

Finland on 20th April 209. "Our task

today is to maintain, or rather ensure for the future, the balance of producers

of energy resources, transit states and consumers of energy resources," he said.

The new pact is to cover oil, gas, nuclear fuel, coal and electricity and to

include the US,

China and India as well as

European countries.

On

15th May 2009 four agreements shall be signed in Sochi: the national companies of Serbia, Greece, Bulgaria and Italy shall sign

agreement with the Russian ‘Gazprom. One of them is agreement

between Serbia’s Srbijagas

and Russia’s Gazprom on route

of Southern Stream pipeline through Serbia with length about 450

kilometers. There shall be also a fifth agreement – bilateral

agreement between Russia and

Italy, which shall be signed by the

Prime Ministers of the two countries, Vladimir Putin and Silvio

Berlusconi.

(Blic

13.5.2009)

c)

Companies

The

consortium behind the Nabucco now comprises six national energy companies: Botas

(Turkey), Bulgargaz

(Bulgaria), Transgaz

(Romania), MOL

(Hungary), OMV

(Austria), and RWE

(Germany). However on Jan. 25, 2008

OMV sealed a deal for a joint venture with Gazprom for extending Baumgarten’s

storage and distribution capacity. Accordingly, Gazprom holds a 50 percent stake

there. Moreover, OMV has been buying into Hungary’s MOL. Considering Russia’s significant

share in OMV, any amount of OMV ownership of MOL again translates into stakes

for Russia’s energy giant. Even further

challenging the Nabucco project is the fact that OMV and MOL, together with yet

a third consortium member, Bulgargaz, have already signed up to Gazprom’s South

Stream project.

Nabucco

The

pipeline that the EU hopes will bring gas from the Caspian Sea to

Austria takes its name from Giuseppe

Verdi's 1842 opera, Nabucco. The

work tells the story of the oppression and exile of Hebrew slaves by Nabucco, a

Babylonian king, better known to the English world as Nebuchadnezzar. The opera

deals with the eternal quest for freedom, but the choice of name may yet prove

fateful for a project that is facing so many obstacles to its

completion.

The

pipeline is supposed to transport around 30 billion cubic meters of gas

annually. In terms of gas suppliers the project's backers have named

Iran, Iraq, Azerbaijan and Turkmenistan.

However

Turkmenistan's gas output is

contracted to Russia up until 2028. Azerbaitzan

also does not have the amounts required so as for the project to be profitable

in the long run. The possibility of Iranian gas is far from realistic due to its

nuclear program and the adamant denial by Israel and the

opponent Sunni Arab states. Nabucco is still counting on gas

supplies from Azerbaijan

despite a memorandum of understanding signed between Russia’s Gazprom and the State Oil Company of

Azerbaijan SOCAR signed on March 30th 2009 clearly shows the growing interest of

Azerbaijan in cooperation

with Russia.

32

European countries are clients of Russia’s Gazprom.

Despite EU declarations and investment plans the US-backed Nabucco

natural gas pipeline is dying a slow death. Even its strongest supporters have a

hard time demonstrating its commercial viability. The

risk for Nabucco is that if the supply and funding issues are not sorted out,

the EU's dream of energy freedom will remain an aspiration rather than a

reality.

South

Stream

Its

planned route would run from the Russian Black Sea coast across the seabed to

Bulgaria, then bifurcate into

a southern branch to Greece

and southern Italy and a

northern branch into Serbia,

Hungary, and

Austria, with a potential

detour to Slovenia and

northern Italy.

Bulgaria and

Hungary have both signed government

agreements on joining South Stream. Austria is also in talks and has already agreed

to sell Gazprom 50 percent of the shares in Baumgarten, the gas hub where

Nabucco is supposed to end, while Turkey already operates a direct sub-marine

pipeline linking it to Russia - Blue Stream.

Also Romania is open to investing in the

Gazprom pipeline South Stream, not just the EU Nabucco project.

On

December 2008, Russia and

Serbia signed an umbrella

agreement providing political guarantees that Serbia will

receive a stretch of the South Stream gas pipeline and that the underground gas

storage facility in Banatski Dvor will be finalized. At the same

time a 51 % stake of Serbian Oil Industry (NIS) was sold to

Gazprom.Slovenia

backed South Stream gas pipeline in the midst of a European gas crisis Jan. 2009

while Gazprom tried to secure pledges on the South Stream gas pipeline to

Italy. The Slovenian delegation said

during the meeting the implementation of the South Stream project would both

diversify the European energy sector and allow Russia to

transit its gas without obstacles. A portion of the pipeline would

travel through Serbia and

Hungary with options to

include a leg through Slovenia to northern Italy.

In

September 2008, Uzbekistan

and Russia agreed to build a

new pipeline with a capacity of 26 to 30 billion cubic meters (bcm) annually to

pump Uzbek and Turkmen gas to Europe. Such a

pipeline will again undermine the US efforts to pump trans-Caspian energy routes

bypassing Russia.

The

technical and economic assessment of the land where the pipeline will lie is

planned to be completed by the end of 2009, while the assessment of facility's

underground stretches should be finished in early 2010.

Russia's Gazprom plans

to start gas deliveries to Europe through the

future South Stream pipeline no later than 2015.

Iran

However,

the whole situation is good for Iran. Some experts believe that

without Iran the “Nabucco” project will

remain unimplemented, while its participation could give an impulse to the

process. Iran

has the largest gas reserves in the world after

Russia and

Turkmenistan (27,5 trillion cubic

meters, or 18% of the world's gas reserves and 33% of that of the OPEC).

But is

there gas coming from Iran?

Iran uses the lion's share of

produced gas (360 million cubic meters daily) for civil purposes. By the year

2014 Tehran

plans to provide gas to 93% of the population of 630 cities and to 18% of the

rural population in more than 4,000 villages. Iran's factories

and electric power plants also need much gas. Another share of the produced gas

Iran has to inject into its

reserves to keep oil production at a high level (experts say this help

Iran increase output by more than

30%). Iran has long been enjoying

infrastructure for oil exports but yet has not such for exporting gas.

On

February 21st 2009 the Iranian and Turkmeni governments signed an agreement that

will give Iran the rights to

develop the Yolotan gas field in Turkmenistan. The deal will help

Iran resolve gas supply problems in

its north-eastern provinces. Turkmenistan will sell Iran an additional 350 billion cubic feet of gas

annually, more than doubling current supplies of almost 300 bcf a year,

according to the agreement first disclosed by Iran’s official media and later confirmed by

Turkmenistan.

Iran also

recently offered to invest $1.7 billion for a 10 percent stake in the second

phase of Azerbaijan’s huge Shah-Deniz gas

field which will come on line by 2014. Iran already has a 10 percent share

in the first phase and it wants to import large volumes of gas from the Azeri

field. For Iran, the deals couldn’t be better

suited to its objectives. It’s economically unviable currently to supply gas to

its isolated, north-eastern third of the country. Getting gas from

Turkmenistan would therefore

make more Iranian gas available for export to Turkey. Also,

connecting both Caspian countries to Iran via pipeline would allow Tehran to accomplish its long-held objective of transiting

any gas production increases from its neighbours to customers in Europe, the

Persian Gulf, or Asia.

Turkmenistan

Preliminary

indications are the gas reserves in Turkmenistan is around 38.4 TCM – far more

than Iran and just 20% lower than Russia. The biggest gas field discovery was in

October 2008 – called the Yoloten Osman deposits. It is located near the Afghan

– Turkmenistan border.

Turkmenistan has contracts to

supply Russia with 50 bcm

annually, China with 40 bcm

and Iran with 8 bcm annually. The Russian

energy giant Gazprom requires this Turkmen gas to meet its export obligations in

the European market, which accounts for 70% of the its total revenue. Gazprom

sells 2/3 of Russia’s 550 bcm annual gas

production in the rapidly growing domestic market. This compels it to secure

Turkmen supplies to meet contracted European demands.

Nabucco

vs. South Stream

Gazprom

has received an invitation to join the Nabucco pipeline project to pump gas from

Central Asia to Europe, but will not take up the offer, a deputy head of

Russia’s energy giant said. In an

interview with Vesti TV on Monday, Alexander Medvedev said Gazprom would stick

with its South Stream project and stay out of Nabucco. “Unlike in the case of

Nabucco, we have everything we need for this project [South Stream] to

materialize,” he said. “We have gas, the market, experience in implementing

complex projects, and corporate management.”

The

Nabucco route does circumvent Ukraine, but it is from Turkmenistan and Kazakhstan, goes under Caspian Sea, passes across

Azerbaijan,

Turkey, and

Georgia. So many countries in

pipeline are creating multiple political risk compared to South Stream which

goes from Russia under

Black Sea directly to EU zone.

Besides, Nabucco is going to lack the resource base adequate to its

transit capacities unless the project is joined, for example, by

Iran, but this is politically

problematic.

The

shareholders of the Nabucco consortium are: Botas (Turkey), Bulgargaz (Bulgaria), MOL (Hungary), OMV(Austria), RWE(Germany) and Transgaz (Romania).

OMV, MOL and Bulgargaz have also signed up to South Stream

pipeline, which bypasses Turkey. It is unrealistic to think

that both South Stream and Nabucco will happen, but companies want

to make sure at least one of them happens and be part of that.

The

current timeframe, assuming that the outstanding issues are resolved, is that

Nabucco would come on-stream in 2013, two years after Nord Stream, the planned

Baltic pipeline, which has already secured both supplies and finance for the

construction work.

Some

geopolitical aspects

The

EU's new "southern corridor" has been dubbed a version of U.S. "Silk Road

Strategy" aimed to block Russia from gas fields around Caspian Sea and its

connection to Iran (More in my article "Is GUUAM

dead?). The South Pars natural gas field brings a new element

to change original U.S. plan as it is a sign of a long-term energy alliance

between Moscow and Tehran and with active participation of the EU.

Turkey and

Armenia may be join the project as

transit countries. Naturally, this leaves Washington very few chances to lobby

its energy projects in the region aimed at using Azerbaijan and Georgia as the

so-called 'Caucasus communication corridor'.

In addition Russia, Iran and Qatar have taken the decision to

form a "big gas troika". The idea is that three countries - with 60 % of global

gas reserves - will work on joint projects accross the entire gas chain from

geological exploration and production to distributionand marketing gas. Alexey

Miller – Head of Gazprom - stated at the end of the meeting that “we are united

by the world’s largest gas reserves, common strategic interests and, which is

very important, high potential for cooperation within tripartite

projects.

There

is also a question about Turkey. The

South Stream pipeline will run from Russia directly to Bulgaria across the Black

Sea. Russia is diversifying its gas supply

routes so as not to depend on one transport hub. It might perhaps be cheaper to

build the new pipeline along existing route of the Blue Stream, which crosses

the Black Sea from Russia to

Turkey, than to lay a new route on

the seabed. This, however, would increase the aggregate capacity of the two

streams to about 48 billion cubic meters, giving the Turks a great deal of

influence on Russian supplies.Russia and the EU countries do not want this to happen.

On the other side Greece,

which is taking part in the construction of an oil pipeline from Burgas in

Bulgaria to Alexandroupolis, has

announced its readiness to join the South Stream project. This makes sense, as

apart from bringing economic dividends it will make Greece an international energy hub on a par with

Turkey.

Bottom

line

In

conclusion EC is pushing imaginary project of Nabucco pipes with support of

drowning USA who’s last straw

of Silk Road blocking strategy Nabucco is.

EU countries as well non-member states are pushing national

interests; Iran, Turkmenistan and Azerbaijan are looking the best

deal, Russia tries keep domination of gas markets and secure the resources, EU

companies are playing with two cards to secure being with winners side and EP of

course is bystander...