Need a reason to explain the massive central bank intervention from China, to Japan, Switzerland, the ECB, England and all the way to the US? Forbes may have one explanation: "It appears that a big European bank got close to failure last night. European banks, especially French banks, rely heavily on funding in the wholesale money markets. It appears that a major bank was having difficulty funding its immediate liquidity needs. The cavalry was called in and has come to the successful rescue." Granted the post is rather weak on factual backing and is mostly speculative, but it would certainly make sense. That said, it harkens back to our original question: just how bad was the situation if the global central banking cabal had to intervene all over again, and just what was not being told to the general public? Lastly, and most important, slapping liquidity Band-Aids on solvency gangrenes does nothing but buy a few days at most. Furthermore, we now expect the stigmata associated with borrowing from the Fed to haunt each and every European bank as vigilantes will now use the weekly ECB update on borrowings from the Fed as a signal to hone in on this and that weak Italian and French, UK, German, pardon, European bank....

Latest Move Shows Desperation

The coordinated swap line bailout by the Federal Reserve Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank- and China’s reduction of reserve requirements by .5% – shows desperation. (For background on swap lines, see this, .)

The Street notes:

Don’t get flustered by the terminology of “dollar swap lines” above. Here’s a more simple explanation: Central banks around the globe have acted in desperation to boost liquidity in the system, which has sparked a rally in equities.

In a separate article, The Street points out:

What’s great for the banks isn’t so good for everyone else, though. Investment strategists already are noting the desperation of the move, adding that flooding the banking system with liquidity doesn’t do anything to solve the real problem of ballooning, unmanageable debt levels.

Ron Paul said today:

The Fed’s latest actions in cooperating with foreign central banks to undertake liquidity swaps of dollars for foreign currencies is another reason why Congress needs enhanced power to oversee and audit the Fed. Under current law Congress cannot examine these types of agreements. Those who would argue that auditing the Fed or these agreements with central banks harms the Fed’s independence should reevaluate the Fed’s supposed independence when the Fed bails out Europe so soon after President Obama promised US assistance in resolving the Euro crisis.

Rather than calming markets, these arrangements should indicate just how frightened governments around the world are about the European financial crisis. Central banks are grasping at straws, hoping that flooding the world with money created out of thin air will somehow resolve a crisis caused by uncontrolled government spending and irresponsible debt issuance. Congress should not permit this type of open-ended commitment on the part of the Fed, a commitment which could easily run into the trillions of dollars. These dollar swaps are purely inflationary and will harm American consumers as much as any form of quantitative easing.

The Fed is behaving much as it did during the 2008 financial crisis, only this time instead of bailing out politically well-connected too-big-to-fail firms it is bailing out profligate government spending. Citizens the world over deserve better than this. They deserve sound money that cannot be manipulated and created out of thin air by central planners who promise printed prosperity. Fiat money caused this European crisis and the financial crisis before it. More fiat money is not the cure. The global fiat currency system has proven itself a failure, we need real monetary reform. We need sound money.

As last year:

Ron Paul points out that the Fed opening its swap lines to Europe violated its promise to Congress not to do so. Paul also says the bailout will help lead to the destruction of all fiat paper currencies, ensuring that “gold will rule the roost”.

***

Many have predicted that it is only a short-term measure to kick the can down the road. But the numbers themselves show that the bailout might not even be having a sufficient short-term effect.

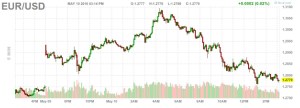

For example, as the following Euro to Dollar chart shows (courtesy of Finviz), the Euro rallied, and then sunk back almost all the way to it’s pre-bailout level today:

[And see this.]

(The Euro’s rally against the Japanese Yen didn’t last very long, either. And Morgan Stanley’s Stephen Hull thinks any rally in the Euro will be short-lived, anyway.)

As Bloomberg notes, bank swap and libor rates show that the bailout might not be enough to stem the sovereign default crisis:

Money markets and the cost of protecting bank bonds from losses show investors are concerned the almost $1 trillion rescue plan announced by European leaders may not be enough to contain the region’s sovereign debt crisis.

A credit-default swaps index linked to European banks that usually trades tighter than an investment-grade benchmark is 30 basis points higher, according to CMA DataVision. A measure of banks’ reluctance to lend remained three times higher than it was in March.

***

The difference between [libor] and the overnight indexed swap rate, the so-called Libor-OIS spread that rises as a signal banks are less willing to lend, climbed yesterday even after the rescue announcement. The rate advanced to 18.83 basis points, from 18.11 at the end of last week and 6 basis points March 15.

Morgan Stanley emerging market strategist Rashique Rahman says that – even after the bailout – Europe’s troubles are growing:

Liquidity provision or not, sovereign credit risk has not gone away. Our work suggests ongoing deterioration of DM sovereign creditworthiness going forward, manifested by further downward credit rating pressure. Additionally, the transference of periphery Europe indebtedness to that of core Europe via the stabilization fund – and further, via ECB purchases – bears very close monitoring. Contamination to the core (of DM) lies at the heart of contagion for EM – which again is manifested through DM funding market stresses.

Nouriel Roubini told Bloomberg that the bailout is not a cure-all:

The implications of the plan require fiscal austerity and higher taxes, damping growth and possibly extending economic hardship, Roubini said.

“In the short term, raising taxes and cutting spending is going to imply further recession and further deflationary pressures in the euro zone,” Roubini said.

Greece, Spain, Portugal, Italy, Ireland and other members of the euro zone may struggle to comply with the fiscal requirements and to restore competitiveness after years of an appreciating euro boosting growth, Roubini said. Euro zone countries’ ability to act may be hindered by divided governments such as the U.K.’s hung parliament, German Chancellor Angela Merkel’s weakened clout, and the continuing protests in Greece, he said.

In the longer-term, Simon Johnson points out that the bailout creates huge moral hazard risks:

This is a whole new level of global moral hazard – the result of an alliance of convenience between troubled governments in the south of Europe and the north European banks (and implicitly, north American banks) who enabled their debt habit. The Europeans promise to unveil a mechanism this week that will “prevent abuse” by borrowing countries, but it is hard to see how this would really work in Europe today.

***

The European Central Bank intervention and this package raise enormous moral hazard issues. The ECB’s management was forced into this kicking and screaming. It was only when they realized that the whole euro zone financial system was at risk of collapse that they threw the kitchen sink at the problem. This can now go two ways: either they tighten fiscal policy across the eurozone, and introduce much more rigorous and enforced rules on deficits and profligate credit through banks, or, they let a system persist which is another “doomsday machine” that will live again to grow, and could one day topple them.

And Johnson notes that the bailout might for even more painful decisions in the long-run:

As Willem Buiter (formerly Bank of England, now at Citigroup) remarked last week, you have the greatest incentive to default when you are running a balanced primary budget (i.e., after substantial budget cuts) and still have a large government debt outstanding. His point is that the incentive structure of these programs means they will postpone a decision to default which would otherwise be rational now.

***

The underlying fiscal problems in Europe could fester – and the “rules” designed to limit moral hazard may turn out to be a complete paper tiger. In that case, the Europeans again have to make a fateful decision: Do they try to inflate out of the debt burdens of their weakest member countries; or do they instead try to manage selective default, keeping in mind that most Greek debt at that stage will be held by other eurozone governments.

As Yves Smith notes:

The real problem is that there appears to be no impetus towards a longer term solution. How do solve imbalances within the eurozone? Without a plan to develop a plan on that front, this simply rearranging the deck chairs on the Titanic.

Of course, the myriad fraudulent schemes (using derivatives and other means) to hide the problems of Greece, Italy and other countries are still continuing to some extent. And the size of the too big to fails means they can take down companies or nations using high-frequency trading, short-selling, credit default swaps and other means. Indeed, Jim Rickards argues that the bailout won’t really help because “Goldman can create shorts faster than Europe can print money”.

Therefore, without fundamental reform of the financial system, there can be no true and lasting European recovery.

Indeed, the fact that China coordinated its big cut in reserve requirements on the same day that the big Western central banks and Japan extended swap lines shows the magnitude of panic among world economic leaders.

Is history repeating?

But At Least a Handful of Insiders Will Make Out Like Bandits

Jim Quinn writes:

When you see such coordinated action by all the major Central Banks in the world, you know the situation is much worse than you are being told by the ruling oligarchy. The confidence and trust is gone. Every major bank in the world is insolvent, whether it be in the U.S., Europe or China. These Central Banks are owned and controlled by the very banks they are bailing out. They are telling you they have it under control. They do not. They have lost control. The debt is too great and will destroy the economic system of the world.

This is a last ditch effort by those in power to grab the last vestiges of middle class wealth. The stock market will soar today, benefitting bankers, politicians, and the 1%. They have solved nothing. The debt remains. The debt will not be paid.

Oil, food and commodity prices immediately soared on this announcement. Again, the wealthy will get richer and the average American will be destroyed by inflation on the things they need to live. The game goes on.

Indeed, just as with Hank Paulson’s little tip to the big boys – which is nothing new – some insiders probably made a killing by being tipped off about the swap lines. See this and this.

This isn’t a financial crisis … it’s a bank robbery....