Brussels, We Have a Problem.... LOL

There were two pieces of news today that enabled the Euro (FXE) to benefit from a much needed relief rally. First, the German Supreme Court ruled in favor of the legality of the Greek bailout package. Then the Italian Senate approved a $70 billion austerity package that is a prerequisite for the rolling over of the country’s existing debt.

With news this dramatic, you would expect the Euro to launch a major rally of three, four, or even five cents. But the best the damaged and suspect currency managed was a feeble one cent rally.

It is an old trader’s nostrum that if you throw good news on a stock and it fails to go up, then you sell it. The European currency is starting to meet that qualification.

It’s not like there is a shortage of reasons to dump the Euro. The sovereign debt crisis and the conjoined banking crisis have sent Europe’s economy into a tailspin. GDP forecasts for the continent are rapidly crash landing down to zero.

It is only a matter of time before European Central Bank President Jean Claude Trichet admits that he committed a major policy error by raising interest rates for the Euro twice in the first half of the year. The inflationary fears that prompted him to stumble badly have proven to be a phantom. Oil alone has fallen by $25 since the last rate hike, and many other key commodities are now showing losses for the year.

The next move on interest rates has to be down, possibly as far as to zero. American interest rates are already at zero and can’t go any lower. This is all hugely Euro negative and dollar positive.

Now that the Swiss franc (FXF) is out of the picture as a viable short, hedge fund traders are trolling for fresh meat to kill. Newly invigorated by the overnight fortune they made on the Swiss franc, the focus now has to be shifting to the Euro.

The break of the 50 moving average on the charts is signaling to technicians that we may be about to break out of the $1.40-$1.46 range that has prevailed all year to a new, lower $1.36-$1.40 range. Demolish that, and we could be eventually headed towards $1.17, and even parity against the buck.

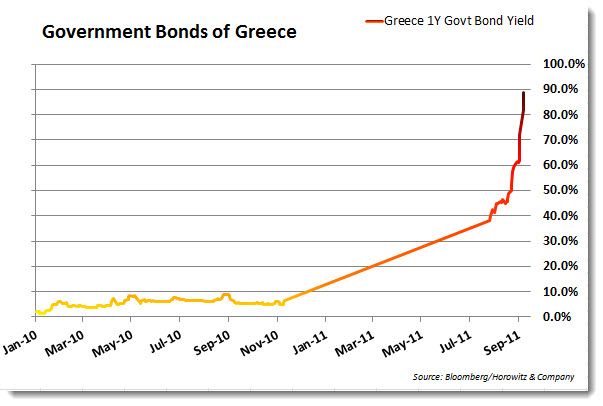

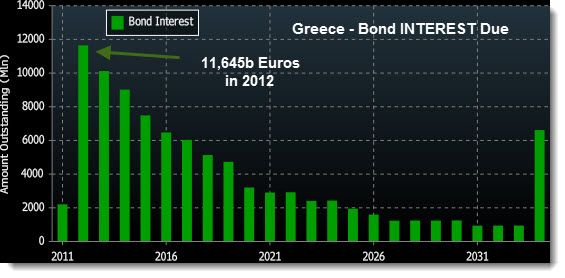

What will be the headline that finally blows down the European house of cards? The inevitable default of Greece, which after looking at the charts below, could happen at any time, with or without a bailout.

-

Nowhere is the debt trap more treacherous than in Valdemoro, a once-burgeoning dormitory town less than twenty miles south of Madrid, frontier of the suburban sprawl that stretches far across the parched Castilian plateau toward Toledo. Here, Rolando Jimenez, a 40-year-old Peruvian security guard, is attempting to enter the now foreclosed and auctioned apartment he bought in 2006 for 216,000 euros, courtesy of a 90 percent mortgage from Basque savings bank Kutxa. Jimenez and his Russian wife had dared hope that a protest held the previous day by a hundred or so young indignado activists, outside the bank’s head office in central Madrid, might ward off the bailiffs. But that was just the euphoria of the demo. “They’ve been and changed the lock,” he says, forcing the key to no avail.

During the frantic construction of the bubble years, this new suburban frontier of apartment blocks, chalets and malls turned Madrid into Europe’s third largest city -- after London and Paris -- as mass immigration pushed the population of the Spanish metropolis past 5 million. Now it is a semidesert of ghost housing estates. Five miles farther south, a burning wind blows like a hair dryer through the empty blocks of Residencias Francisco Hernandez in Nueva Seseña. The eponymous developer, known popularly as Paco El Pocero -- the drains man -- planned to build 13,500 apartments financed by a consortium of five banks, and openly encouraged buyers to flip their properties for a profit once the papers were signed. Now banners hang from half-finished blocks: “Pocero: you neither sell nor you pay.”

Beyond, shimmering in the heat, a forest of signs advertise new chalets at discount prices. “When they liberalized zoning requirements, twenty million square meters of farmland here became buildable overnight,” says former mayor of Seseña Manuel Fuentes, of the Communist Party-led Izquierda Unida coalition. Spain built more homes in mid-decade than Germany, France and Italy combined, many in suburban developments outside the big cities, even more as vacation homes on the Mediterranean coast. Now between 700,000 and 1 million remain unsold, with little prospect of a recovery in the foreseeable future. Perversely, though possibly a sign of things to come in November’s general elections, Fuentes lost the Seseña town hall in the May poll to the very same deregulating People’s Party (PP) that liberalized zoning in the late ’90s.

Valdemoro and Seseña could be Southern California. Another burst bubble in the desert. But the Jimenez family finds itself in a worse trap than the foreclosed masses of the American Southwest. Here there is no key in the envelope dispatched to the bank before moving on. Unlike in California, strategic default on home loans is not recognized in Spain, and once the house is sold at fire-sale prices, the remaining mortgage debt is still claimed by the bank after foreclosure. This is a life sentence for Jimenez, who, like so many low-paid workers on the European periphery, blindly saw opportunity in debt. He channeled up to 80 percent of his wages into mortgage payments before rising interest costs and a shortage of work forced him to cease paying last year. Now in temporary rented accommodation, after paying 85,000 euros to Kutxa, he still owes 115,000.

Maybe it is a sign of how bad things are in Spain, but the Platform for Mortgage Victims, the housing spinoff of the innovative indignado protest movement that filled Spain’s plazas in May, looks west for inspiration: “We want what many already have in the US: the chance to hand over the home and be free of debt,” says Eloy Morte, who has led a series of actions aimed at preventing evictions. There are 300,000 foreclosed homes in Spain, and Morte reckons 20,000 families were evicted in the first six months of 2011.

As anxious bond investors force up interest rates on the sovereign debt of the eurozone periphery, Jimenez’s trap personifies a solvency crisis that threatens the integrity of the European monetary union. It is the mirror image of the early days of the eurozone, when cheap money pumped up housing bubbles in Spain and Ireland and a credit boom financed nonproductive investment, from retail to tourism, in Portugal and Greece. Over the course of the first seven years of monetary union, combined private and public debt tripled in the countries of the periphery, reaching levels four or five times greater than their economies. Ratings agencies, as seduced by eurozone convergence as they were by US subprime mortgages, placed peripheral bonds on a par with German bunds. External debt soared, especially in Greece. Exports from the core countries to the north poured in, and new highways, built with Siemens material, were soon crowded with new Audis and BMWs. “Local business abandoned manufacturing, started building shopping malls and hotels, and our external balances collapsed,” says José Reis, an economist at the University of Coimbra in Portugal.

By the end of the decade, all of the so-called PIIGS (Portugal, Ireland, Italy, Greece, Spain) relied on billions of euros of capital inflows to fund massive current account deficits. When Lehman Brothers collapsed in September 2008, the flows froze up and the bubbles burst. Official financing packages provided by “the Troika” of EU governments, the European Central Bank and the IMF, in exchange for rescue packages, forced austerity measures on Greece, then Ireland, then Portugal. Spain and Italy cut back too, under pressure from markets and the European authorities. Growth plummeted. Spanish unemployment, always the Achilles’ heel of the post-Franco economy, returned to 20 percent, almost double its boom levels, concentrated among youth and immigrants -- many of them new homeowners ensnared in the mortgage trap. Falling tax returns turned a private debt crisis into a public one, and by 2010 Spain’s combined public and private debt was five times its GDP. In Ireland it climbed above 1,000 per cent, as the housing slump dragged banks into insolvency and the economy shrank 15 percent over three years.

* * *

Ireland is perhaps the most shocking case of the eurozone debt trap. A bailout of zombie banks, headed by Anglo Irish -- creditor extraordinaire of the big Irish property moguls who had aggressively redeveloped Europe over the past decade, from Knightsbridge to the Costa Brava -- cost the taxpayers a staggering 70 billion euros. At 44 percent of GDP, it was the costliest bank rescue ever. With an estimated 300,000 empty dwellings in a country of only 5 million inhabitants, Ireland was looking at a legacy of overbuilding that was a blight as ugly as that in the Madrid exurbs.

When I drove toward Cork from Dublin earlier this year, a slick new complex of condominiums in Newtownmountkennedy, twenty miles south of the Irish capital, promised the “summit of life in the garden of Ireland.” But the apartments were empty, as was a brand-new four-star hotel in the complex. “No one knows where these apartments are,” remarked a shop worker enigmatically at the new shopping mall opposite. Farther inland the situation is worse, says Rob Kitchin, a geographer at the National University of Ireland in Maynooth. The ghost estates that litter Ireland’s pastoral interior deteriorate faster in the dank climate than in the arid exurbs of Madrid. “Cracks open up; plants grow through. Many will have to be demolished.”

Meanwhile, in Greece and Portugal, the poorest of the original countries in the union, IMF-designed austerity measures have wound the development clock back decades. Motivated by lurid stories in German tabloids of public sector workers happily retired at 50 or unscrupulously claiming the pensions of their deceased relatives, the Troika has forced cuts to pensions averaging 20 per-_cent in Greece. But, while retirement at 58 after thirty-seven years’ employment was possible in some jobs before the draconian pension reform, there was another reality beyond the scope of Bild’s banner headlines. “Old age poverty is back just as we had begun to combat it,” says Christos Papatheodorou, a poverty expert at Democritus University of Thrace.

Portugal, with a minimum wage of just 470 euros per month even before the crisis, has seen an explosive increase in the number of working poor as value-added tax increases push up the cost of living. “Families on food support are up 40 percent,” said Isabel Baptista of the Center for Social Research in Lisbon. This is the collateral damage of austerity and “internal devaluation,” the only Brussels-approved exit from the debt trap. With currency devaluation no longer an option to regain competitiveness, because of the universal adoption of the euro, wage and benefits cuts will enable low productivity economies in the south to export their way out of the crisis. Or so the theory goes. It’s an exact reincarnation of the economic orthodoxy in vogue before John Maynard Keynes arrived on the scene in the midst of the Great Depression.

But flaws in the austerity thesis have appeared like cracks in an abandoned ghost estate. As spending cuts and a deteriorating world economy threaten to trigger a double-dip recession in the eurozone, the bond markets have suddenly learned the devious logic of the austerity paradox. After clamoring for wage and spending cuts, investors now fear the impact of low growth on debt and have pushed rates up even further, making the cost of financing the debt of the peripheral countries at least three times higher than that in Germany. And in a monetary union, where a country is indebted in a currency it does not issue, investor panic tends to produce the very results it most fears. “Money leaves for safer parts of the union, and a liquidity crisis becomes a solvency crisis,” says Paul de Grauwe, a Belgian economist who has been a clairvoyant critic of the new orthodoxy in the eurozone.

Whereas in the United States, Britain or any developed economy with its own currency, a debt crisis can be resolved by the purchase of debt by the central bank -- generating some very welcome inflation -- Greece, Portugal and Ireland find themselves in a trap familiar to Latin America in the ’80s and ’90s, indebted in dollars. In a catastrophic act of denial, the statutes of the monetary union, agreed upon in the ’90s, avoided any reference to sovereign insolvency or even bailouts for individual member states. Just as foreclosed homeowners in Spain or Ireland lack a strategic default mechanism to escape their mortgage debt trap, the eurozone has no bankruptcy procedures for insolvent members. Nor does the European Central Bank (ECB) have a means to buy newly issued debt and act like the US Federal Reserve, as a lender of last resort. The result: at every turn, the official response to the crisis has been desperate improvisation.

* * *

First to receive emergency financing in April 2010, Greece was also first into insolvency a year later. At an emergency summit in Brussels this past July, the Troika recognized, finally, that Greece’s 350 billion euro debt was not payable, and cobbled together a so-called soft default procedure designed to minimize losses to its external creditors, mainly German and French banks. Ireland and Portugal looked sure to follow, despite the summit’s insistence that they had “solemnly” promised to meet their obligations. All three had received Troika support when their interest rates broached 7 percent and debt service costs soared out of control. By midsummer, as bond vigilantes and hedge funds geared up for a gargantuan test of nerves with the ECB, the interest rates on the bonds of Spain and Italy were both above 6.5 percent and rising. In one apocalyptic week in August, even France seemed to have been targeted, and analysts began to ask where the eurozone periphery began and where the center ended.

While bond purchases by the ECB held off the markets in August, the central bank insisted that it could not continue buying peripheral debt and that the new European Financial Stabilization Fund -- a eurozone IMF -- should take on that role. Most economists agreed that this would require at least a tripling of the fund’s 440 billion euro resources, a daunting prospect given public opposition to support for the periphery in the core countries, especially Germany.

There was also a growing consensus in the eurozone center left that in the medium term, only the conversion of members’ sovereign debt into euro bonds, backed by an embryonic United States of Europe, would placate the markets and avoid the breakup of the union. A European New Deal based on euro bonds and public investment financed by the European Investment bank is now supported by several social democratic leaders, even in Germany. “The model should be Treasury bonds like those issued under Roosevelt to finance public works; this was federal debt and did not require the backing of individual states,” says Stuart Holland, a veteran of the European left who was an adviser to former European Commission president Jacques Delors, who has garnered support in parts of the European establishment for a Euro-Keynesian response to the debt trap.

But this is all anathema to the German government, which shares the US Tea Party’s abhorrence of expansionary policies to boost growth and employment. Finance minister Wolfgang Schauble called euro bonds the road to “inflation union.” At a meeting in August, a statement by German Chancellor Angela Merkel and French President Nicolas Sarkozy rejected an expansion of the fund, and even an initial small issue of euro bonds.

Meanwhile, center-left governments on the periphery are terrified of worsening the risk premiums on their debt, and express support for the Euro-Keynesian alternative only in comments made strictly off the record. In any case, their tardy support for austerity has alienated their own supporters. Spanish Prime Minister José Luis Rodríguez Zapatero will almost certainly follow his Portuguese counterpart, José Sócrates, who lost the spring election to the fiercely neoliberal Pedro Passos Coelho. Greek socialist George Papandreou’s support has also plummeted against the right-wing New Democracy leader, Antonis Samaras. And, despite encouraging results in elections earlier this year, the Irish Labour Party also risks losing its base support after joining a coalition government whose twin policy of bank bailout and social spending cuts is now parodied in Dublin’s pubs as “No bondholder left behind.”

A second multibillion euro rescue package of EU and IMF loans for Greece did receive the green light in August. But it was made conditional on the privatization of up to 50 billion euros’ worth of state assets -- from utilities and mining companies to the state lottery. The most enticing were 70,000 plots of publicly owned real estate on the mainland coast and islands, some of it pristine beaches on Samos and Prasonisi (Rhodes), owned by KED, the public real estate holding. Imaginative Dutch ministers ventured that state assets might also be used as collateral for the second installation of the Troika credits, an idea Rolando Jimenez would have understood perfectly.

During a visit to Athens in May, I met the dapper real estate broker Miltos Kambourides in the offices of his fund Dolphin Capital Partners, which specializes in luxury tourist development and buzzes with moneymaking acumen. He seemed unfazed by the Spanish experience of boom and bust in the vacation-home business. “There is huge scope for developing the privatized land for tourism here; in comparison to Spain, Greece is virgin,” he told me. The assets were to be packaged in special-purpose vehicles and sold at huge discounts. Who would buy? Elias Karakitsos, who manages Greek ship owners’ fortunes at Guildhall hedge fund in London, answered candidly: “This is the ideal environment for vulture funds.”

Portugal and Ireland have also announced fire-sale privatization programs. With little else left to auction, Spain put its century-old state lottery on the block; and when Italy became the midsummer target of the bond vigilantes, Silvio Berlusconi rushed through plans to privatize state utilities. Public beaches on the Italian Riviera had already been leased, while heavily indebted medieval cities, downgraded by S&P and Moody’s, resorted to selling Renaissance palaces such as the Palazzo Diedo and San Casciano in Venice. “The best way to explain what is happening is that episode of The Sopranos when they lend money to the deadbeat because his wife has a shop they would like to own,” says Michael Burke, a former Citibank economist in London.

But with opposition to austerity and forced privatization growing in Athens, Madrid and beyond, the question for the future is whether the eurozone periphery will continue to obediently make its mortgage payments -- even as the Troika embargoes its most prized assets—or return the keys and move on. This is the great default debate now engaging the European left, just as it did in Latin America in the ’80s and ’90s.

In Greece, a growing indignaki movement defends immediate default and, if necessary, withdrawal from the euro. An unofficial debt audit commission has been set up by activists, following precedents in Latin America, to study the legitimacy of Greece’s 350 billion euro debt. In May, I observed delegates of the new commission at one of the first meetings held at Athens Polytechnic behind the buckled Iron Gate, crushed by tanks during the student uprisings against the military junta in 1973. One committee discussed the legitimacy of debt securitized by Goldman Sachs in the late ’90s to help Greece meet entry requirements to the monetary union. JPMorgan Chase’s role in overselling 280 million euros’ worth of government debt to pension funds in 2007 was also discussed. Another group asked whether debt dating from the Athens Olympics in 2004, whose 9 billion euro bill to taxpayers was four times initial estimates, should be paid. “The truth is, none of it is legitimate; it’s a political vehicle more than just an audit,” said commission member Alissi Vegiri, a physicist at a government research institute, whose 30,000 euro salary has been cut by 23 percent in the past year. Debtocracy, a documentary film distributed for free online that calls for default on odious debt run up by corrupt administrations, was seen by a million people in Greece within a month of its release in April. That’s one in every ten Greeks. Parts of the Irish and Portuguese left have followed suit and set up their own audit commissions.

These groups are looking closely at the experiences of Ecuador and Argentina. After taking power in January 2007, Ecuadorean President Rafael Correa formed an audit commission to assess the legitimacy of $3.2 billion in external debt. Then, to the astonishment of banks, bond holders and the world media, Ecuador unilaterally defaulted. Wall Street and the IMF warned that the small Andean economy would suffer permanent ostracism. Yet within two years, Correa’s government had negotiated a buyback of the defaulted bonds for just 30 cents on the dollar, and was back again selling bonds on international markets. Rating agencies now value Ecuador’s debt on more or less the same terms as before the default.

Argentina, meanwhile, broke Latin American growth records after its own massive debt restructuring in 2001. But default was not enough. A massive devaluation of the peso was also needed to boost exports and provide space for expansionary macroeconomic policies to generate growth and employment. “We’re following the example of Argentina both on default and devaluation, which means exiting the euro,” said Costas Lapavitsas, an economist at the University of London’s School of Oriental and African Studies, who is involved in the campaigns in Greece, Portugal and Ireland. However traumatic withdrawal from the euro would prove for the periphery, unless Berlin and Frankfurt agree to assume their debt, it may be the only escape from the trap.

Andy Robinson, a reporter for the Barcelona daily La Vanguardia

No comments:

Post a Comment