The findings you are about to read have been shared with the United Nations, UK Parliament, and to select Fortune 500 Companies...

But they've never been released to the public before today...

Recently, a team that includes an energy adviser to 16 world governments, a pathologist, and an expert in non-linear trends in the financial markets uncovered a startling pattern that has led them to conclude that our futures may very well be...

The Ultimate

Pyramid Scheme!

Their controversial investigation was filmed with the purpose of alerting the public to this dangerous catastrophe that is just over the horizon...

Below is the official transcript

John Daly:

What if I told you that, in the coming years, many of the very things

Americans take for granted, like our access to easy energy, cheap food and

water...

Even the money in our pockets...

Could be gambled away, due to history's biggest Pyramid

Scheme?

What if I could mathematically prove with one simple pattern, that the

future we've been promised – is a lie inside of a lie.

And what if I told you that the world, as we know it, may soon become

rife with conflict, and unrecognizable from the one we grew up in?

All frightening concepts.

But what if they're true?

And what if the only ones who will escape the Pyramid Scheme unscathed,

before it collapses, are those who take the proper steps now.

Today, I'd like for you to join me as we investigate...

Hello, my name is John Daly.

And I want to thank you for participating in this critical event

today.

For the longest time, Americans were led to believe that we lived in an

age of perpetual prosperity...

By now, we know that was one all-encompassing illusion.

We saw the new reality firsthand, as the recession shook the very

foundation of our economy.

Even today, we are still struggling to rebuild our great

nation.

However, many voices we've come to look upon as authorities want you to

believe that the worst is behind us.

Are they right?

Most Americans feel we are simply experiencing the calm before the

storm.

A recent survey found that 61% of Americans believe a historic

catastrophe is looming just over the horizon...

It may be an economic collapse.

A terrorist attack.

Or a natural disaster.

But only 15% feel prepared for such a deeply troubling event.

In 2012, the state of Wyoming debated legislation known as the Doomsday

Bill in case of events like these unfolding.

And in recent years, six other states contemplated similar

measures.

USA Today recently wrote that some experts believe

that...

And the Federal Reserve has prepared a study that assesses the

possibilities of a future scenario where we see a 13% jobless rate, 50% Wall

Street plunge, and a further 21% decline in housing prices.

People are scared.

They are concerned the days ahead will be darker and more uncertain than

anything they've experienced before.

Now what if I told you that they are right to worry?

That a catastrophe is not only coming, but it is a mathematical

certainty.

In this groundbreaking broadcast we are going to discuss the harsh

realities regarding our future with a diverse team of scientists, economists,

and energy analysts.

They've researched the likelihood and consequences of Peak Energy,

American food and water shortages, resource wars, plus a coming global financial

catastrophe, the likes of which, the world has never seen before.

And their analysis has led them to believe that our future has become one

dangerous pyramid scheme that's on the verge of collapsing.

And when it does, it will put your investments, your wealth, and your way

of life at risk.

In fact, their findings show that not only are the warning signs out

there, you can easily see them by just observing an undeniable, mathematical

pattern.

One that keeps appearing in many things critical to how our society

functions.

Members of this acclaimed team of experts you are going to meet today

have already presented their research to governments around the world and the

United Nations.

And now they are going to walk you through an eye-opening, and, at times,

frightening investigation.

So you can decide for yourself.

And just as importantly, they are going to show you how to prepare for

the future.

In your day-to-day life... your finances... and your

investments.

So before we begin... let's meet the team that will be conducting this

investigation.

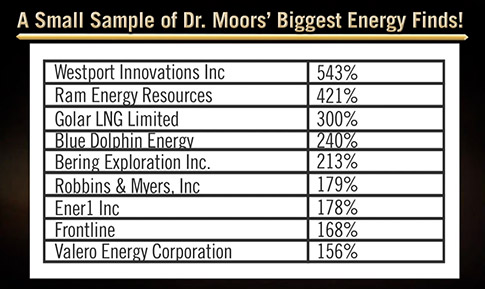

Dr. Kent Moors is one

of the world's leading energy analysts.

He has advised 16 world governments on

energy matters, and currently serves on two State Department task

forces.

One that provides oil and energy

policy to developing nations.

And another focused on Global Shale

Gas development.

Dr. Moors also has an extensive

background in counter intelligence, which has led him to be called upon

regularly by the National Security Council, Department of Energy, and numerous

government agencies.

And until recent revisions in U.S.

policy, Dr. Moors was slated to be the deputy director of the Iraq

Reconstruction Management Office in Baghdad.

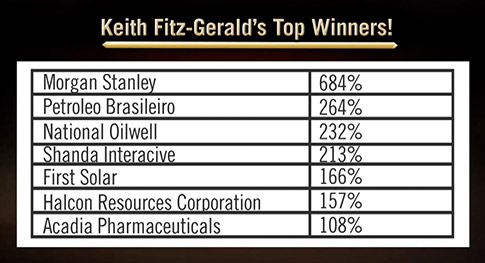

Keith Fitz-Gerald is

the Chairman of the Fitz-Gerald Group, as well as the Chief Investment

Strategist for Money Map Press, where his daily analysis reaches 500,000 readers

in 35 countries.

Keith has worked with think tanks

around the world using his expertise in the science of complexity and in

non-linear trends in the financial markets, to help policy makers predict future

events, and prepare for them.

Keith's investigations have resulted

in him predicting the 2008 oil shock, the credit default swap crisis that helped

bring about the recession, and also the Greek and European fiscal catastrophe

that is still wreaking havoc to this day.

His research into the coming resource

wars has also made him a leading authority on determining where the next global

conflicts will arise and what their trigger points will be.

Chris Martenson is a

highly acclaimed author and scientist with a Ph.D. in Pathology from Duke

University.

He is the former VP of a Fortune 300

company and has become an internationally recognized expert on the dangers of

exponential growth in our energy, environment, and economy.

He has presented his powerful findings

at the United Nations, the UK Parliament, State Legislatures Across the Country,

and to major corporations.

Now I want to warn you in advance, that some of what you are about to

hear may come as a shock to the system regarding your current

beliefs.

But let me assure you that there

is hope.

While the evidence is overwhelming, the next chapter of the story you are

about to hear has yet to be written.

So let's get started by catching up with Chris, Keith and Kent as they

lay out their plans for this investigation.

Part I: The Meeting

The Theory is Presented

Present at Investigation: Chris Martenson, Keith

Fitz-Gerald, and Dr. Kent Moors

Location: A diner in Baltimore, MD.

Time: Monday Morning

Location: A diner in Baltimore, MD.

Time: Monday Morning

Chris Martenson:

Around the turn of the millennium, I started taking an interest in

exactly how the economy functions.

As a pathologist, I wanted to look at it through a scientist's

eyes.

When I did, it wasn't long before I got this sense that a potential

catastrophe was beginning to take shape.

One that threatened the prosperity and well being of all Americans, and

most of the world.

My wife calls this period the time I "fell down the rabbit

hole."

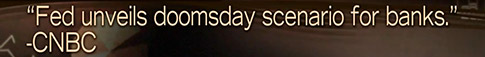

What I discovered is a very simple mathematical pattern that appears in

many things critical to maintaining our way of life.

It's going completely undetected.

Probably, because it doesn't look out of the ordinary at first

glance.

But when you dig deeper, it reveals, with absolute certainty, that our

current path is unsustainable.

And it looks a lot like a Pyramid Scheme to me.

But unlike the Bernie Madoff situation, or any of the other ones we hear

about on the news, this Pyramid Scheme isn't being carried out by an individual,

or a group of criminals.

It's much bigger.

Its foundation is rooted in how we exist as a society.

We're all complicit to varying degrees in it.

Dr. Kent Moors:

Your research has definitely created a bit of a controversy.

And that's why we've all agreed to work together to investigate this

Pyramid Scheme theory.

Chris Martenson:

It's only controversial because some folks in Washington and in other

world governments refuse to accept reality.

The most important thing we need to get across to the American public

about a Pyramid Scheme is that it is always unsustainable.

The end result is pre-determined.

The only thing in question is how long it takes to crash.

The proof is right in front of us - we're in the midst of one right

now.

You can see a Pyramid Scheme loud and clear on a simple chart.

I can just draw it on this napkin.

You are two of the foremost experts in the world on what this basic image

can mean.

Our job is to show people that this pattern could rob countless innocent

folks of their wealth, freedoms, and frankly their futures.

We have to open people's eyes and give them a way out.

A way to position their investments, life savings, and daily decisions so

that they are ready for what's coming.

Dr. Kent Moors Side Interview

The Dangers of Exponential Growth

Dr. Kent

Moors:

What Chris drew on that napkin

represents a dangerous pattern that our society has been built upon.

An exponential growth curve.

Looks harmless on that napkin.

But it's very troubling when applied

to the real world.

When exponential growth creeps into a

system...

Doesn't matter whether it's an

economic system, energy system, or some simple system you may have at your

job...

When that exponential growth begins,

it's nice and calm.

It goes unnoticed for a long while,

because that system stays small at first.

But what's happening underneath the

radar is that system keeps doubling in size, over and over again, in shorter

periods of time, until it hits unsustainable levels.

That's when chaos breaks

out.

With a traditional Pyramid Scheme you

usually have some sort of crooked operation that survives off a constant influx

of new people investing their money, so that the people on the top of the

pyramid get paid.

You need exponential growth in the

amount of investors, or else the pyramid scheme collapses when more and more

people want their money back.

But our Pyramid Scheme theory suggests

something entirely different.

That our way of life has been built

upon unstable exponential growth needs.

The problem is, exponential growth

patterns don't give you an early warning sign.

Because the dangers really speed up at

the end, when it's too late to do anything about it.

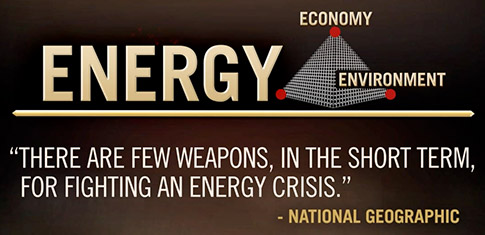

Chris Martenson:

Now, to maintain our current way of life, the so-called American Dream,

we have to rely on the false belief that we can preserve exponential growth

forever in three systems, Energy, the Environment, and the Economy.

I call them the 3 Es.

The Economy on the top, with Energy, and the Environment forming the

foundation.

An interconnected pyramid.

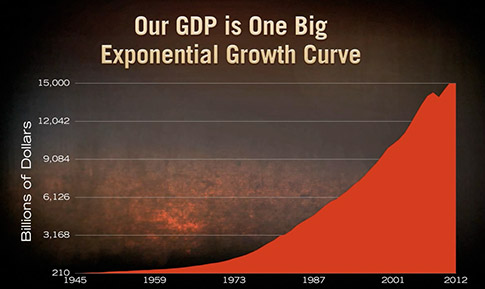

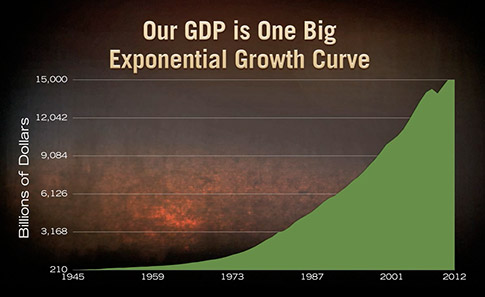

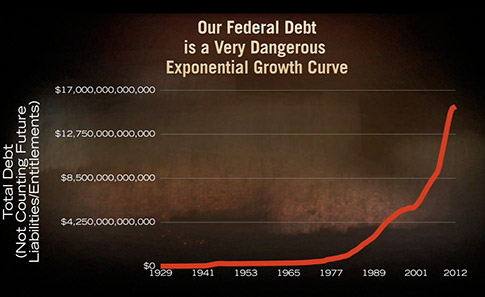

Looking at that top E – the economy - our GDP is a near perfect

exponential growth curve, doubling and doubling repeatedly over the last 80

years.

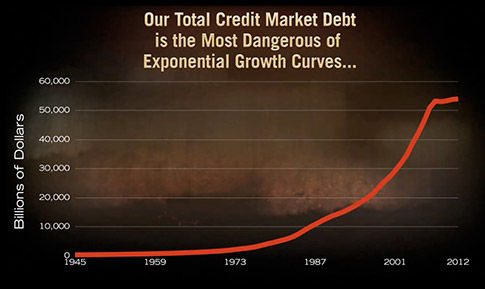

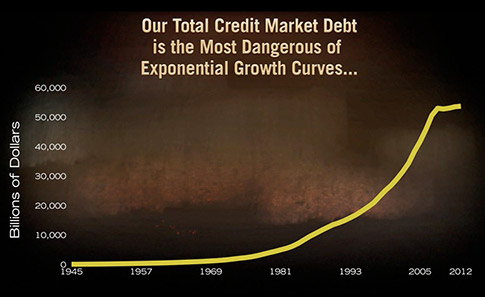

But something that was experiencing even more dangerous exponential

growth is our Total Credit Market debt.

Doubling around every 6 or 7 years since the mid-70s.

Keith Fitz-Gerald:

If our economy would just continue to grow infinitely, we could keep this

going for a little while longer.

But we'd also need to continue a pattern of exponential growth in our

ability to find and harness more energy...

Grow more food from dwindling amounts of farmland...

Find new water sources from deeper beneath the ground...

Discover and mine a whole array of crucial minerals.

What we are finding out more, with each day that passes, is that all of

these things are finite in nature.

But they are absolutely necessary for maintaining our current living

standards in a modernizing world with 7 billion people...

Chris Martenson:

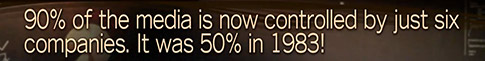

Unfortunately, politicians, pundits, and the mainstream media don't look

at the big picture.

They focus on inflation, debt, or unemployment.

Or green energy obsessions versus drill, drill, drill.

Or high food and gas prices.

But they never look at how interconnected everything is.

If they did, they would see that these 3 Es form one big, historic

crisis.

Dr. Kent Moors:

To really drive this Pyramid Scheme theory home we just need to have

people begin asking themselves some very important questions.

What is the real fallout if the world is caught in the midst of an energy

crisis?

Not just oil. Energy across the board.

What if there's an international run on minerals, water, and

food?

What if we can't continue to grow these areas exponentially for a global

economy that's built on infinite expansion?

And what happens to America, and the entire world, if one piece of this

puzzle falls behind, or even worse yet, all of them?

We have some very real issues to address that, for the first time in

history, may find their way to American shores.

And I think that's the story people need to hear.

Will This Theory Hold Up to Scrutiny?

John Daly:

Let me jump in for a second.

Chris, Keith, and Kent have begun to outline their Pyramid Scheme

theory.

But will this hold up to scientific scrutiny?

We aim to get to the bottom of that question today by exploring

dangerous, exponential growth patterns in our energy, environment, and economic

systems.

The three Es.

Then the team is going to connect them together to form the big

picture... the pyramid... and what this means for our futures.

They'll also give you their analysis on how to protect your wealth and

way of life when this catastrophe truly erupts.

In our first segment, you will discover why militaries from around the

world believe we are running straight into a full-blown energy

crisis.

We'll share some government reports, that were never meant to be seen by

the public, which may reveal that our days of easy oil are behind us.

The team will assess all energy sources for their viability in helping us

lessen the blow in the days after our petroleum-based economy comes to a

close.

But you'll see how these solutions won't be enough to stop the Pyramid

Scheme from crashing down.

And remember, Chris, Kent, and Keith are leading, international experts

on energy.

In fact, Kent currently spends most of his time consulting with world

leaders on this pressing issue.

For most of his career, he was on a 72-hour standby with our government

for major energy issues.

Meaning, at any time, he could be taken for 3 days, with no warning

whatsoever, to address major events in oil, anywhere on the planet.

So his viewpoint is not one to be taken lightly.

Now, before we dive deeper into this investigation, let me say that this

is a complex issue.

And one we don't plan on rushing through.

Because you deserve the truth.

Part II: The Truth About Peak Energy

Present at Investigation: Chris Martenson, Keith

Fitz-Gerald, and Dr. Kent Moors

Location: Cove Point, Natural Gas Facility.

Time:Monday Afternoon

Location: Cove Point, Natural Gas Facility.

Time:Monday Afternoon

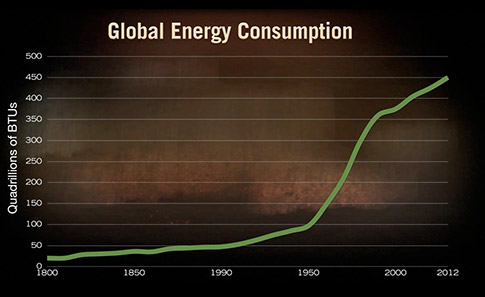

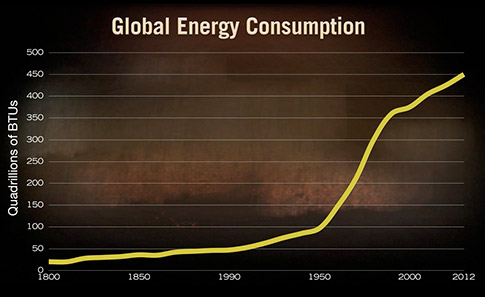

Chris Martenson:

To keep this pyramid scheme from crashing down you need exponential

growth to be maintained forever in those bottom two Es – energy and the

environment.

They're the enablers of this whole setup.

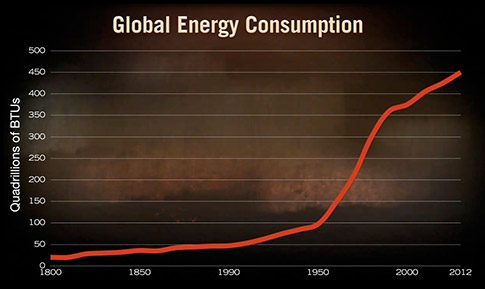

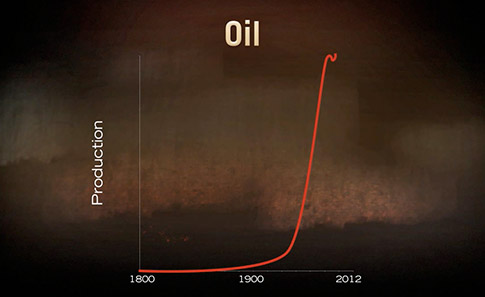

With that first E – energy - we can see a clear cut case for exponential

growth by simply analyzing the amount of energy we've consumed on this planet

over the last 200 years or so.

It looks a lot like that image I drew on the napkin.

You see a long flat period followed by a quick rise.

And that pattern raises a big question.

What happens to our society, our economy, and just about everything else

if we can't maintain this exponential growth pattern?

I think we're about to find out the answer.

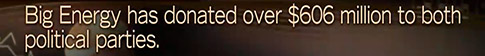

But you won't hear the politicians in any party or the mainstream media

bring this issue up because the big energy companies pad the "donations books"

of everyone in DC.

And big energy pays for a lot of advertising during those supposedly

unbiased news programs.

Money shapes the story of any issue in this country.

And the story the big energy money is selling us is that we've got

nothing to worry about.

But they're wrong.

And I believe there is no quick fix for this energy

predicament.

Dr. Kent Moors:

It's amazing that in the time since we kicked off the industrial

revolution, we have basically extracted all of the easy energy there is to be

had using our past, current, and near-future technologies.

And we're now so far behind the curve towards mass integration of any

viable alternatives, like the natural gas that's here at Cove Point, that our

society is on the cusp of an energy shock like we've never

experienced.

There is no getting around this.

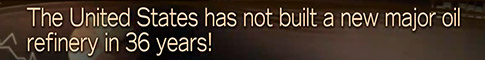

Look at oil.

New oil doesn't appear magically overnight.

And neither do new oil refining processes.

The amount of oil on this planet is finite.

How finite is a big question on the minds of many scientists.

Chris Martenson:

This is why I've taken such an interest in the idea of Peak

energy.

Peak Oil in particular.

Keith Fitz-Gerald:

You know, it wasn't that long ago that "Peak Oil" was simply an

extremist's view.

But the militaries of the world now seem to be taking it very

seriously.

They're the ones driving the research because they realize its potential

impact on economies, on maintaining a stable society, on exposing weaknesses in

enemies, and for identifying where the geopolitical power shifts may

occur.

It goes so far beyond filling up at the pump.

And it's essential to this Pyramid Scheme.

Dr. Kent Moors:

I've read and analyzed these military reports very carefully.

Some have a great deal of truth to them.

And others I'd suggest need to do a little more homework.

But these investigations are certainly sounding some serious

alarms.

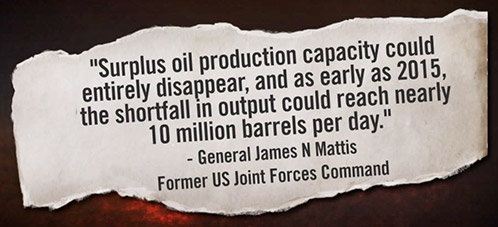

Last year, the U.S. Joint Forces Command released a study warning of a

coming oil crisis that could begin any minute now.

They think this could be the year surplus global oil production entirely

disappears.

And by 2015 we may be coming up 10 million barrels short every

day.

But they're really only focusing on crude oil there, not the alternative

oil forms.

Keith Fitz-Gerald:

The investigation that caught my eye was the one from Germany's Federal

Defense Force.

This draft was never meant to be seen by the public, but it was

leaked.

I thought this was a game changer.

This report predicted that a future of dwindling oil supplies could lead

to dramatic shifts in the global balance of power...

And a decline in the importance of the western industrial

nations...

That means us.

They predicted peak oil could bring about a total collapse of the

financial markets.

And serious social, political, and economic crises could strike the

entire world.

If people were looking for a wake up call, this wasn't a bad

one.

Chris Martenson:

You know Germany's findings were certainly the ones that garnered the

most attention, but the UK also reached similar conclusions.

We know their Ministry of Defense, Bank of England, and Department of

Energy were holding secret talks about peak oil.

It is something that is way beyond the realm of conspiracy theories these

days.

And Americans need to prepare for it.

But they also need to understand it further.

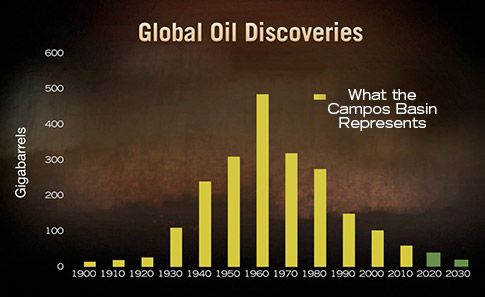

Side Interview with Chris Martenson:

What is Peak Oil?

Chris

Martenson:

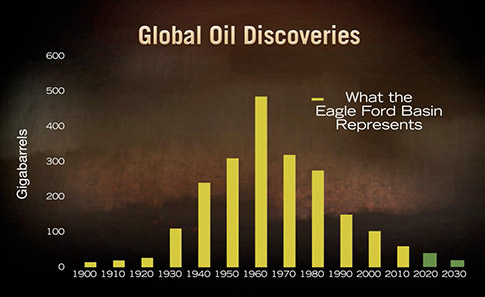

Here's a quick breakdown on Peak

Oil.

It's a theory that began in the

mid-1950s from a man named Marion Hubbert.

Hubbert was a geoscientist, who worked

at the Shell research lab in Houston, Texas.

His peak oil theory refers to the

point in time where the world is unable to increase the supply of oil brought to

the market because there just isn't as much to be extracted from the ground

anymore.

It's not a matter of running

out.

Let me be clear about that.

But it is a matter of slowing

down.

The fact is world oil discoveries

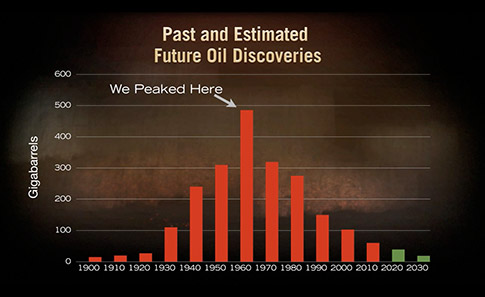

peaked in the 1960s.

And that, while we kept producing more

and more oil in the decades after the so called "Peak," it became just a matter

of extracting more oil at a faster rate than we're finding it.

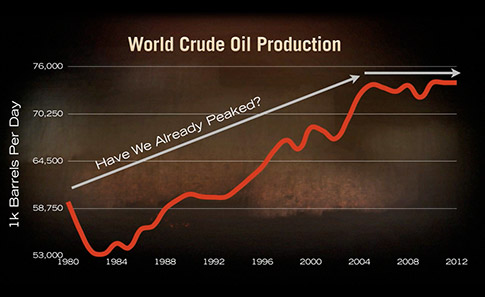

Some organizations now believe we may

have already passed the peak in the amount of oil we can bring out of the ground

from those very wells.

Take the International Energy

Agency.

The IEA.

Their data shows that the world may

have begun to reach peak oil production around 2006.

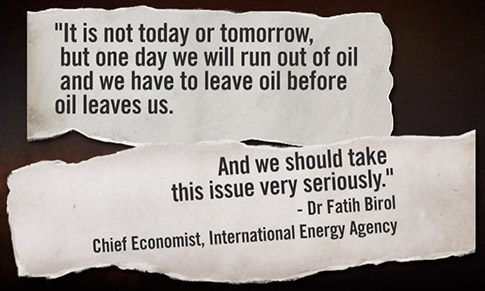

The IEA's chief economist even stated

that...

Many Americans believe we've become a

net exporter of oil.

It's a very big

misconception.

And that's possibly why this situation

isn't getting the attention it deserves.

Here's the reality: We are a net

exporter of oil-based products.

There's a big difference between that

and being a net exporter of oil itself.

That just means our refineries are

shipping out more gasoline and other products than we take in.

But it's still oil we imported in the

first place that we are refining and then turning around and exporting

out.

The hard truth is, we're very soon

going to be living in a world of very expensive oil.

There was a meeting last year that

included some high-ranking U.S. Government and military officials.

One of the participants was the

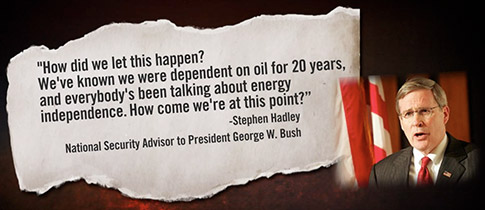

National Security Advisor for President George W. Bush.

He proposed a simple

question.

Keith Fitz-Gerald:

If you want to know why there aren't many of the "powers that be" taking

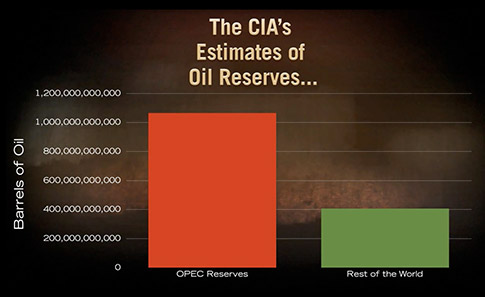

the peak oil situation too seriously, look at OPEC.

I believe they are blatantly lying to the public about how much oil they

have in their reserves.

We know that while America, and much of the world, was seeing its

production slow down back in the 1980s, somehow the Saudis were able to

magically increase their "proven" oil reserves by as much as 127%.

But nobody audits OPEC, but OPEC.

People can say what they want about Wikileaks, but one thing that website

may have done was expose some very dirty secrets about peak oil in the Middle

East.

There were no less than 4 cables that were uncovered between the U.S.

Embassy and Saudi officials that suggested Saudi oil reserves were being

overestimated by as much as 40%.

And that peak oil was imminent.

Chris Martenson:

The Wikileaks weren't the only warnings of this.

Oxford University believes OPEC has been overestimating its reserves by a

third.

And that we could enter into an oil crisis by 2014, when supply can't

keep up with demand.

Keith Fitz-Gerald:

Right.

It's no mystery why Oxford sees a crisis looming.

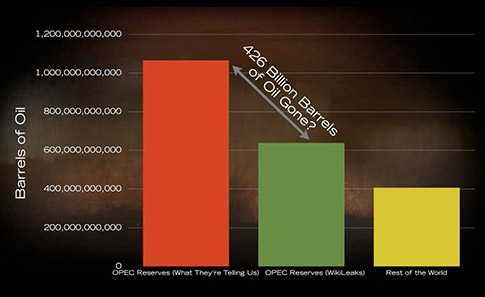

If you are to believe OPEC, then they have about two and a half times the

amount of oil in their reserves than the rest of the world combined.

Just imagine the impact if they are doctoring those numbers.

We could be talking about 426 billion barrels of crude oil... 13 years

worth for the entire planet... not just the Middle East... gone.

Up in smoke.

Dr. Kent Moors:

I was recently at Windsor Palace in England meeting with UK ministers and

ambassadors from 12 countries, and I explained that we have a very serious

energy situation on our hands.

It's not one to be taken lightly.

But I will tell you, without any reservations, that the extremists' view

on peak oil is built on a myth.

We won't go to sleep one night in an oil-rich nation, and wake up the

next day, and it'll all be gone.

The U.S. Geological Survey estimates we have about 2 trillion barrels of

oil yet to be discovered.

They believe that'll last us 70 years at current consumption

rates.

Now the caveat to that is the idea of "current consumption

rates."

With what we are seeing in China, and the emerging markets, 70 years may

be overshooting how long oil will last by a bit.

But we won't go dry anytime soon.

Here's the real situation...

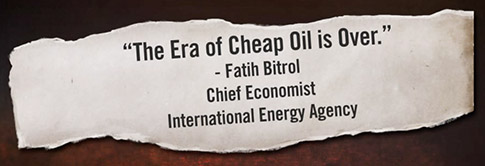

We have long reached, and passed, the days of easy and cheap

oil.

What we are doing to cope is transitioning from more traditional crude

oil, the cheap stuff, to the unconventional forms like shale, bitumen, and oil

sands.

This stuff is much more expensive and energy intensive to get out of the

ground and bring to the market.

And it eventually means dramatically higher costs.

We've got a race against time on our hands here that we aren't going to

win.

Eventually, oil will become so costly, it will force America to finally

transition off it.

But the problem is we haven't taken anywhere near the necessary steps to

make a bold leap into something like the natural gas that comes through this

facility.

In a few years, we'll all look back and wish we had $7- or $10-a-gallon

gasoline.

And that's for the cheap stuff.

I mean, they're already paying that in Europe.

But you're not just going to feel it at the pump.

You're going to feel it everywhere.

Keith Fitz-Gerald:

Global demand, alone, is going to push oil prices through the

roof.

Between now and 2035 you have 90% of the world's population growth, and

90% of the energy growth, coming from emerging markets.

Oil companies know this because they've already dog-eared $20 trillion

towards finding new oil from more difficult places.

Because crude is going to be that valuable.

And it will hit all of our wallets hard.

But this still doesn't mean the oil isn't there.

40 or 50 years from now is a different story.

Chris Martenson:

I think between 2013 and 2016, Peak Oil will become an internationally

recognized, indisputable fact.

And when that happens, oil will be $300-a-barrel at its

cheapest.

So where do you see oil prices heading?

Dr. Kent Moors:

I see that price eventually.

Maybe the backend of your timeframe.

But what I'm about to say, I was recently told directly by multiple

ambassadors from the Gulf Coordination Council in a private meeting.

They represent the oil interests of the Persian Gulf.

So we're talking OPEC folks here.

They told me that, by 2014, they have to have a minimum, I want to stress

minimum, price of $125-a-barrel to maintain their economies in the Middle

East.

So without any other factors in play, that'll be the lowest oil can ever

go again.

But we know that there are always other factors that come into the oil

game.

So my take is that $150-a-barrel will be the "new norm" very

soon.

What I mean by that is, we'll hit a point where, regardless of whatever

economic pullbacks and events take place, that will be the lowest price oil ever

drops to.

And that time is not that far off.

Probably 2013.

Keith Fitz-Gerald:

I'll one up you Kent.

I think we could hit $200-a-barrel in 2013.

Although, we could see some quick panics if Iran decides to play

geopolitical Russian Roulette and blocks the Strait of Hormuz.

Or even worse yet, they break out into conflict with Israel.

Also, a terrorist attack hitting an OPEC nation could have big

implications for America, too.

That could lead to temporary gas lines and dramatically inflated prices

in the short term.

And then $200-a-barrel will look like roses compared to

reality.

Dr. Kent Moors:

I agree.

The solutions we hear politicians and so-called energy experts talk about

on TV never take into account one alarming trend that's been getting worse and

worse over the last century.

The ratio of Energy Return on Energy Invested.

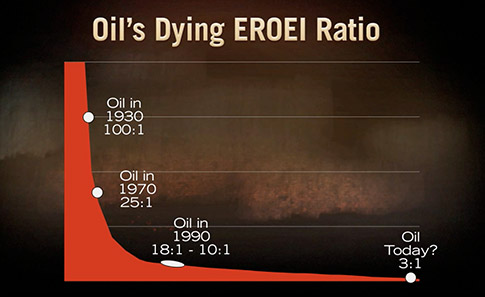

Side Interview with Dr. Kent Moors:

The Death of Oil's EROEI

Dr. Kent

Moors:

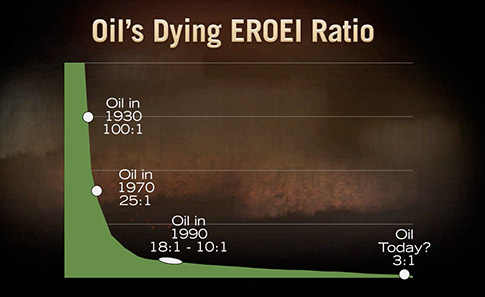

Energy Return on Energy Invested, or

EROEI for short, simply measures how much energy it takes to get energy out of

the ground.

In the 1930s you could get about 100

barrels of oil out of the ground for every one barrel you used.

By 1970 that figure was

25-barrels-to-one.

Today, we're only getting about 3,

maybe 5, barrels of oil, for every one barrel of energy we use to extract

it.

It's another exponential growth

curve.

And what's unfortunate is that trend

is not likely to improve, regardless of where we choose to drill.

Whether it's Alaska or the Gulf of

Mexico.

As an oil guy, it pains me to say

that.

So if we find out we have some

untapped treasure trove of oil somewhere deep underground, it will still be

incredibly expensive to get it, simply because of this EROEI

ratio.

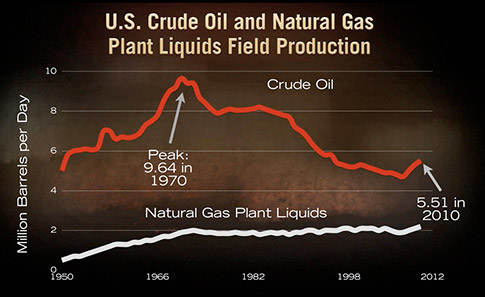

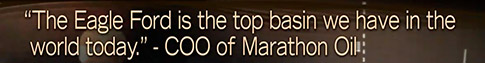

Chris Martenson:

It's undeniable that the United States' conventional crude oil production

peaked in 1970.

Forty-eight other countries saw similar peak oil situations, including

Indonesia, which used to be an OPEC member.

We just don't get the major oil finds anymore like we used to.

The press went crazy when another big oil well was discovered in the

Campos Basin in Brazil.

As much as 250 million barrels of oil are believed to be

there.

But that would represent a fraction of what we found in oil's hey

day.

The Tupi Oil field, also in Brazil, is a similar story.

Now some of the unconventional forms of oil are certainly getting a lot

of press.

Look at shale oil.

At first glance, it is pretty exciting.

In just the last 3 years alone, Texas has seen a 230-fold increase in

their output of crude oil that's derived from shale.

That's about a 23,000% spike.

It's mostly coming from the Eagle Ford basin.

Unfortunately, the Eagle Ford basin is believed to have only a total of 3

billion barrels of oil for discovery.

And similar big shale formations in the Bakken in North Dakota can only

deliver about 128 million barrels a year.

It's small potatoes compared to what we used to find.

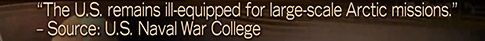

Dr. Kent Moors:

Here's another way to look at it, global oil consumption is now about 89

million barrels a day.

So we could theoretically use up all of the annual production of these

big fields in 2-3 days.

So we better hope there are trillions of barrels of crude lying under the

water in the arctic if we are going to place our chips down on oil for the long

term.

And that isn't a very safe bet at the prices oil is going to hit in the

coming years.

Keith Fitz-Gerald:

If more of the American public asked themselves two

questions...

What happens when oil becomes too expensive because the easy stuff isn't

just lying there under the surface to grab...

And what happens if we aren't prepared for it?

They might be much more worried about their futures.

Because this crisis will put more of a strain on the already dangerous

exponential growth patterns present in our environment and economy.

And this will cause the date of the pyramid scheme's ultimate collapse to

speed up.

It's Impossible to Flip a Switch

and Fix This...

John Daly:

The team has made the case that we are in for some hard times regarding

oil.

But maybe you are holding out hope for an alternative source of energy to

sweep in and replace it.

We'll discuss that next.

But remember, you can't just flip a switch and transition to a new type

of energy.

It can require tens of trillions of dollars of investments in

infrastructure and technology.

And it's never been done quickly.

Consider this, it took about 100 years to transition from wood being the

primary energy resource to coal.

And then another 100 years for coal to be overtaken by oil in

1964.

So what viable replacements for oil exist?

And until one steps up, will an energy crisis play a role in this Pyramid

Scheme theory the team has presented?

Find out ahead.

But first, let me say that we're going to cover a lot of ground

today.

This is a very serious subject matter, and you deserve the real story on

it.

Energy is just our first topic.

We're also going to review potentially catastrophic exponential growth

patterns in our environment and economy.

Do Realistic Alternatives to Oil Exist?

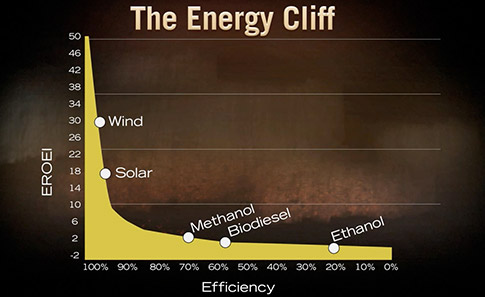

Chris Martenson:

Outside of wind and solar, the renewable energy sources don't offer the

kinds of EROEI returns we need to, A, meet our exponential growth demands for

energy...

And B, fuel continued exponential growth in our environment and

economy.

But solar and wind are impractical for mass adoption and will continue to

be for a very long time.

Plus, neither gives us liquid fuels, no matter how high their EROEI ratio

is.

And liquid fuels are what we most need to run our economy.

Methanol and biodiesel can't cut it, either.

And ethanol is so inefficient, in many cases, it takes as much energy to

produce it as it actually contains.

Dr. Kent Moors:

We are going to be forced to lean on a lot of inefficient energy sources

in the future, including oil.

Take the Keystone Pipeline.

The oil coming out of that is primarily from the tar sands.

The EROEI for that is around 2.9, which is highly inefficient compared to

what we used to get.

But all of the energy options have their faults.

Windmills don't make for great hood ornaments.

And solar panels don't have the juice to get you, or an 18-wheeler, down

the highway.

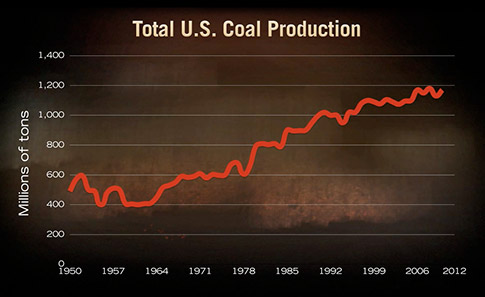

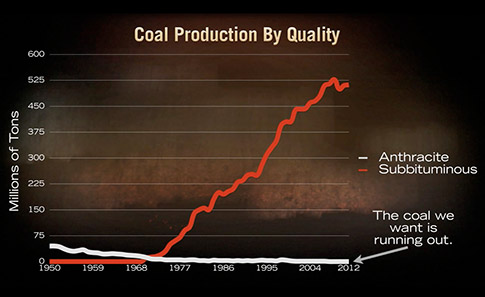

Chris Martenson:

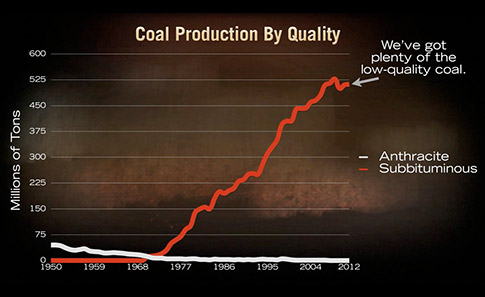

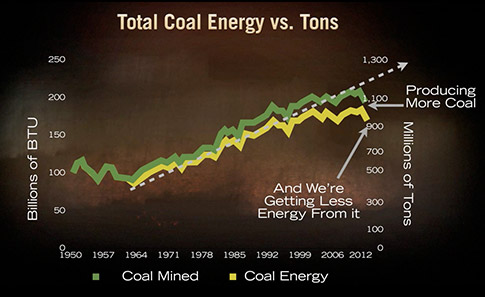

Coal is an interesting story, too.

We produce a lot of it that's for sure.

So much so, there are some experts who want us to believe that we have

250 years of it left in the United States alone.

But you have to dig deeper than that.

We are barely mining the high quality coal.

Anthracite.

Critical to steel production.

It hardly exists in America anymore.

Gone over the last 100 years.

The low quality grade, the subbituminous coal, we've got tons of

that.

That's why, over the last 50 years or so, we keep growing coal production

by about 2% annually.

But the energy we get from those bigger hauls is flatlining.

So we're getting less from more.

Keith Fitz-Gerald:

So here's where we stand from our discussion so far.

We have peak oil. We have peak quality coal. And we didn't touch on it

yet, but we have a similar peak situation with uranium for nuclear

plants.

China has been stockpiling uranium.

The U.S. went on a mid-2000s buying frenzy.

And much of the world has been using uranium from decommissioned nuclear

warheads because what's left in the ground is low grade.

In fact, the best uranium now is about 10% pure.

That's up in Canada.

But most of the other stuff is between .1% and 1% pure.

So once again, you have a situation where it takes a great deal more

energy to extract lower qualities from the ground.

Dr. Kent Moors:

We have one solution in front of us that can act as a bridge until we

make some sort of breakthrough in a renewable option.

Natural gas.

But I'm not quite sure it will help us all feel comfortable about the

future.

The big problem here is that, while natural gas is very cheap, the

infrastructure is not in place, and we'd have issues getting mass adoption

without a complete government intervention.

Which isn't going to happen the way Congress and the White House behave

with one another these days.

But even with those hurdles, I think America is going to lean on natural

gas as much as possible going forward.

That EROEI ratio for natural gas is pretty healthy right now.

It falls around 15 to 1.

So it's much better than oil.

And there's a whole lot of natural gas.

An estimated 100 years-worth in America alone.

Plus, we've got 487,000 natural gas wells across 30 states right

now.

So some big positives there.

Keith Fitz-Gerald:

Unfortunately, by my estimates, we have 60,000 processes in this country

that rely on petroleum.

Everything from growing and transporting food to household items needed

to make our lives easier.

It costs $35,000 to convert a truck engine to natural gas right

now.

$18,000 for a regular car.

And out of the 117,000 gas stations in America, only 500 offer natural

gas to the public.

And even though you have a country like France that offers 62 natural gas

cars to choose from, here in America, you'll be extremely lucky to find a couple

at your local dealership.

So even with natural gas as a viable option, we've got a long road ahead

before it replaces oil.

Chris Martenson:

The real negative is the time to start this massive overhaul of our

energy system was in the 1970s when the U.S. peaked in oil

production.

Fortunately, we aren't starting from scratch with natural gas.

But since we haven't taken the necessary steps to integrate it into our

society, I estimate we are at least 20 years behind the curve.

And we don't have twenty years.

We might not have even five before oil becomes too expensive for

society.

Keith Fitz-Gerald:

So what we're left with is a very solid case that the first of the three

Es – energy - guarantees that our Pyramid Scheme theory comes to

fruition.

Because if our energy system can't continue to grow exponentially, it

definitely won't be able to power exponential growth in our

environment.

And certainly not in our economy.

So we should talk about that next.

Energy is Just the First Domino to Fall...

John Daly:

If our ability to harness cheap energy is limited, this will send

shockwaves throughout our society.

So a little later the team will address what this energy crisis means for

our country, national security, and your prosperity.

But first, to further examine the Pyramid Scheme, we need to discuss the

other two "Es."

Now I want to reiterate something I mentioned at the beginning of this

broadcast.

The next chapter in the story has yet to be written.

You can take steps to protect your wealth and way of life.

So let's move on to the environment.

The second E.

You are about to discover why we may be struck by American food shortages

in the coming years.

You'll hear a startling 200-year-old prediction from an English Pastor

that may now be coming true.

And you'll see why, by 2015, the world could experience armed conflict

over water... not oil.

Energy was just the first domino to fall.

The next two will really drive home the fact that our future is one big

Pyramid Scheme.

Part III: The Perils of Peak Environment!

Present at Investigation: Chris Martenson, Keith

Fitz-Gerald, and Dr. Kent Moors

Location: American Farm, Westminster, MD.

Time: Tuesday morning

Location: American Farm, Westminster, MD.

Time: Tuesday morning

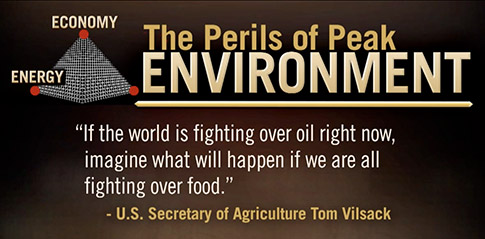

Chris Martenson:

I always find it interesting to listen to people talk about the

relationship between energy and the environment.

Mostly, because I think the wrong story is being told.

It's usually being driven by an environmentalists' agenda.

I'll let folks come to their own conclusions there.

What I'm most concerned with is that, just like with energy, we also rely

on exponential growth patterns with many different aspects of our

environment.

Realistically, we couldn't maintain these patterns even if we had

unlimited energy, but since we don't, it really is the final nail in that

coffin.

Now it would be nearly impossible to investigate all of these exponential

growth factors in the environment.

So I feel we are best suited to focus on the two areas that people think

about the most.

Food and water.

By just linking those two areas to our Pyramid Scheme theory and showing

how they are interconnected with our energy and economic systems, I think we'll

be able to present a fairly open and shut case.

Keith Fitz-Gerald:

Well we've come to the right place to do just that.

Look around gentlemen, because this is something that is going extinct in

this country.

Your average American farm.

For a long time now, we've been seeing less and less of these kinds of

farms across the American landscape.

And I predict that it's going to get much worse as energy prices

surge.

Because you can't grow food without oil.

You can't fertilize it.

You can't harvest it.

You can't transport it.

So what happens when energy becomes too expensive?

You're going to have a mass exodus of small farmers across this

country.

Side Interview with Keith Fitz-Gerald:

The Extinction of Average American Farmers!

Keith

Fitz-Gerald:

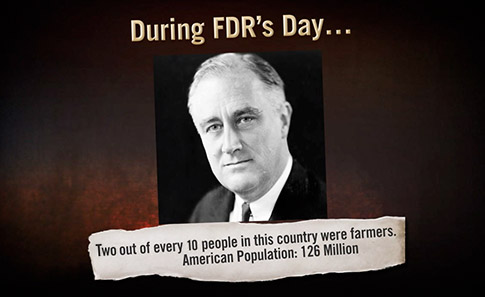

Back in Thomas Jefferson's day, nine

out of 10 people in this country were farmers.

When Lincoln became president, half of

the country was still making a living off the land.

By the time FDR was sworn in, that

number had dropped to two out of every 10 Americans.

Now, only one out of every 500

Americans, is a full-time farmer.

Keith Fitz-Gerald:

So with fewer farmers and nearly 313 million mouths to feed in this

country, where is the food going to come from?

One place - Factory farms.

Agribusiness is booming in America.

Because the basic economics of the food system in our country are pricing

it right out of the average farmer's budget.

And this all plays a big role in that second E, in our Pyramid Scheme

theory... the environment.

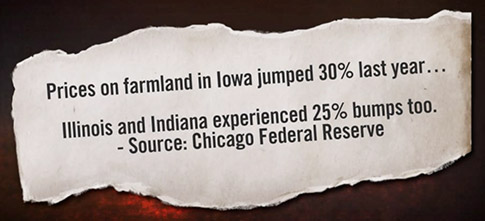

Dr. Kent Moors:

Here's what we know.

The prices of food staples like wheat, beef, corn, sugar, and just about

every food item are up big since the millennium.

But, so is oil.

That's not a coincidence.

Farmland prices have also been going through the roof lately.

And that's because there is so much less of it now.

Over the last 25 years alone, America has converted over 41 million acres

of land into condos, strip malls, and other developments.

That's the equivalent of removing Illinois and New Jersey from the

map.

Add it up.

You've got higher food prices, higher fuel costs, more people, and less

land to use for growing food.

So farming is now, more than ever, a volume business.

And factory farms are the big winner there.

Keith Fitz-Gerald:

It is interesting when you consider that last year farm revenues were the

highest on record.

Yet Time Magazine found that 82% of the income average farmers

bring in is now coming from non-farm sources.

So that means most average farmers have just become

part-timers.

They've been driven out by the factory farms.

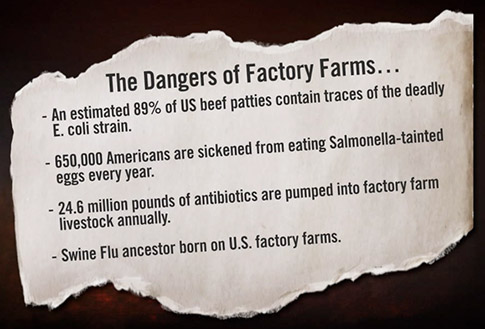

Chris Martenson:

Now here's a scary thought.

What if our future offers no other choice but factory farms?

Big conglomerate entities instead of the kinds of farms we've known all

of our lives.

I think we are left with no other choice here because of some very

obvious exponential growth trends we're running headfirst into.

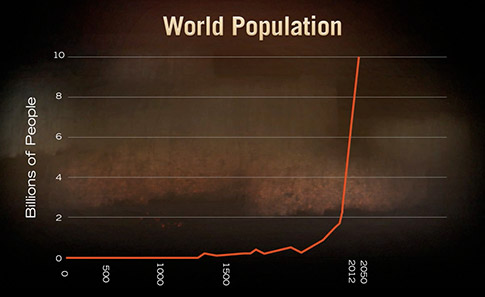

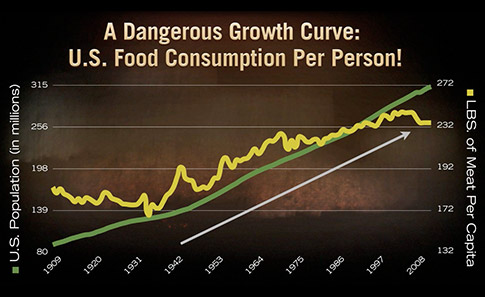

The United Nations' future population estimates form a near-perfect

exponential growth curve.

And it shows you that we're well on our way to a tipping point

here.

More people put a larger drain on our energy needs.

They require more food, more money, more everything.

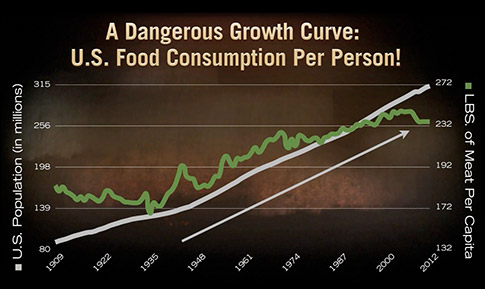

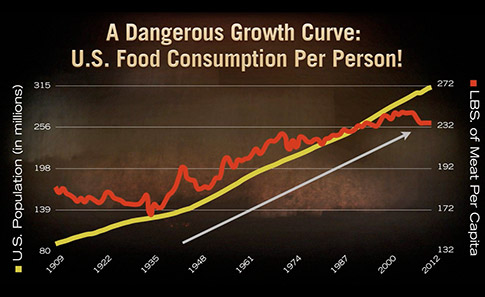

If you narrow the focus to just America over the last 100 years, you'll

see that our food consumption patterns are growing even faster.

Meaning we are eating more food, per person, while our population

explodes, and our farmland disappears.

So factory farms are going to be a necessary evil, just to keep the food

coming.

But it's still unsustainable.

The average person in this country is responsible for 32 metric tons

worth of food, water, minerals, and energy from the environment every single

year.

China and India are modernizing at a rapid rate.

So their populations will put more of a strain on our ability to divvy up

the resources.

At least in a cost-effective manner.

The UN believes we have to double our food production by 2050 to meet the

demands of growing world populations.

Where is that food going to come from?

Only about 1/10th of the land on this planet is suitable for

farming.

About 40% you could put cattle and animals on.

So that's about half of the land we can't do anything with.

And we may have to embrace factory farms, if we want to get

by.

But even those giant agricultural entities are going to fall victim to

our Pyramid Scheme theory in the future.

Keith Fitz-Gerald:

I agree.

Those factory farms require a lot of energy to operate.

Right now the cycle of bringing food from the farm to the market takes up

2/3rds of the United States' domestic oil production.

The average American's food intake for the year requires 400 gallons of

oil to bring it to the kitchen table.

It takes a pound of diesel to make a pound of fertilizer.

So if you've got a big family, you are using a lot of oil just to

eat.

We are going to need unprecedented innovation in how, and where, we grow

food to keep up with the rising numbers in our population.

We're going to need big technological leaps in plowing, fertilizer,

forest management...you name it.

But where are they?

And will they appear in time to avoid a severe crisis?

Chris Martenson:

We saw phosphate fertilizer prices rise 350% from 2003 to 2008, and in

2008 food riots broke out in 40 countries.

I don't think that's a coincidence.

And I think American food shortages are not a matter of "if," but a

matter of when.

To think we couldn't experience that kind of crisis would be

foolish.

Especially when food prices will soar in the future.

Plus, America currently imports 100% of its needs for 18 minerals and

elements.

We are already beginning to accuse China of hoarding minerals.

This will only get worse as our demands increase and these resources

become ever more scarce.

Which means we'll all feel the strain on our bank accounts.

People without the necessary financial stability to afford these

increases will have some tough decisions to make.

Side Interview with Chris Martenson:

The Prophetic Warning of Reverend Thomas Malthus

Chris

Martenson:

Back in the early 1800s a Reverend

Thomas Malthus was one of the first to predict that the world's explosive

population growth would eventually overrun our ability to feed

ourselves.

He was a highly controversial figure,

but his theories have become a mainstay with many biologists and

economists.

Malthus even went as far as to write

that the power of population is so superior to the power of the earth to produce

subsistence for man that premature death must in some shape or other visit the

human race.

Pretty extreme words.

And they didn't come true in his

day.

But back in Malthus' time there were

only 1 billion people on the planet.

It took another 123 years to hit that

second billion.

33 more years to hit three

billion.

14 years to hit four

billion.

13 years to hit five

billion.

12 years to hit six

billion.

And now we're at 7 billion.

It's a near perfect trend of

exponential growth.

And Malthus didn't have to deal with

similar and equally dangerous exponential growth patterns in energy, like we do

now.

So maybe his worries about peak food

were early...

But eventually they may turn out to be

frighteningly accurate.

Part IV: Will Wars Be Soon Fought Over Water?

Present at Investigation: Chris Martenson, Keith

Fitz-Gerald, and Dr. Kent Moors

Location: Potomac River, Washington D.C.

Time: Tuesday Afternoon

Location: Potomac River, Washington D.C.

Time: Tuesday Afternoon

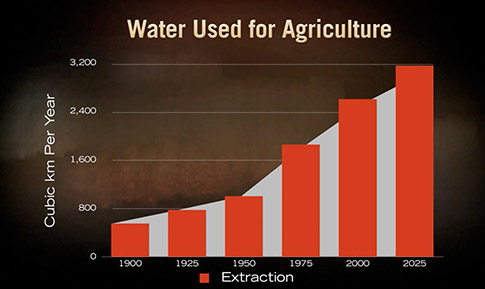

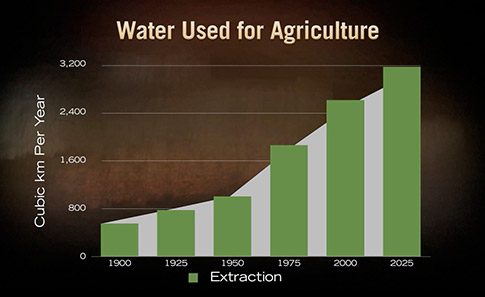

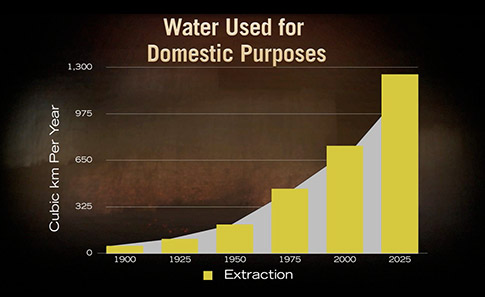

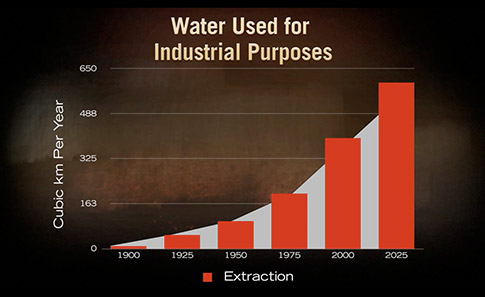

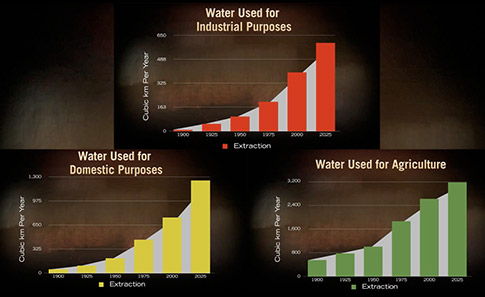

Dr. Kent Moors:

I think water will be a very topical issue in this country within the

next decade.

Look at where we're at now.

The Potomac River.

Runs through D.C., Maryland, Virginia.

There are 7 cities right along this 7-mile stretch here.

Most people don't think about it, but energy plays a critical role in our

ability to use water.

And we all know we need a lot of it to grow food.

Unfortunately, water is also experiencing startling exponential growth

patterns for agricultural use.

The same pattern is appearing for our domestic water use.

And also for our industrial purposes.

Water plays an enormous role in our Pyramid Scheme theory.

Keith Fitz-Gerald:

It sure does.

I was a part of a think tank meeting in Zurich a couple of years back

that investigated the future of water.

This is a much bigger issue than people realize.

We concluded that the likelihood of armed conflicts arising over water

will be extremely high by 2015.

I'm talking higher than oil or Democracy.

That means it's an almost near-certainty.

What makes this notion hard to grasp for some is that we aren't running

out of water.

There's plenty of water around us in lakes, ponds, oceans.

We have the same amount of water on this planet now as we've had for our

entire history.

About 360 quintillion gallons.

That's 360 with 18 zeros behind it.

The problem is, 97% of all water is saltwater.

So you can't drink it, or use it for a lot of agriculture.

And converting it to freshwater is problematic because it's energy

intensive and time consuming.

Which is another predicament all in itself, because in just the last 10

years alone, freshwater demand across the planet has spiked 58%.

I find that startling.

So right there water becomes a big factor in all 3 Es – our energy,

environment, and economic systems.

Chris Martenson:

You are absolutely right.

These are the facts, and I think we can quickly see how they fit into our

Pyramid Scheme theory.

An average person consumes about 731,000 liters of water a

year.

Either by drinking it or in the foods we eat.

And that's without even counting our showers, car washes, or anything

else we can think of.

Now put that in perspective with a world that's adding the equivalent of

over eight New York cities-worth of population annually, and you can see the

problem compounding and compounding.

Dr. Kent Moors:

The water around us here isn't what we need to be concerned

about.

Only about a third of one percent of all freshwater on this planet, just

the freshwater, is found in rivers like this, or lakes.

The water that's a problem is way down beneath the surface, the

aquifers.

These deep wells are the lifeblood of cities across our country, and

entire regions of the world.

And they are becoming unstable, because it takes many human lifetimes to

refill these aquifers.

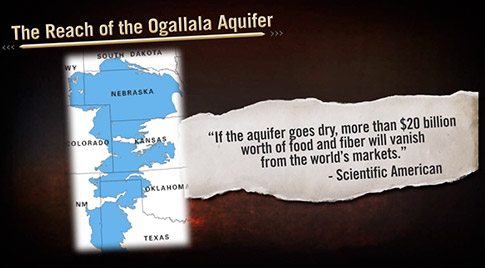

Chris Martenson:

Aquifers don't get much press, but they should.

Look at the Ogallala aquifer.

It touches about 8 different states in the Midwest.

It's massive.

It provides drinking water for 2 million people.

And it's primarily responsible for 30% of the water this entire country

uses for irrigation.

Here's where the cause for concern lies: It may be completely drained

within 25 years.

And it takes 6,000 years to refill.

That's a great deal of cities at risk there of future water shortages to

say nothing of the agriculture issues...

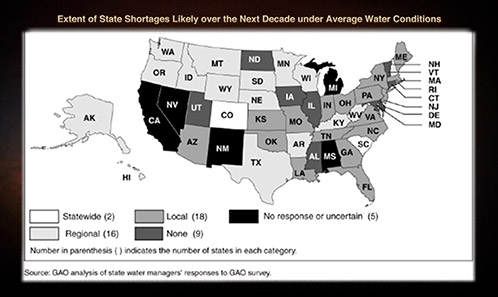

Dr. Kent Moors:

You've got a similar story with Lake Mead out in Arizona.

That helps keep Phoenix supplied with water.

The Scripps Institution gives Lake Mead a 50-50 chance of being dry by

2021.

But the problem is widespread.

You can go back as far as 2003 and see the GAO warning that 36 states are

at risk of serious water shortages by 2013, because of this aquifer

issue.

Chris Martenson:

You know, water is heavy stuff.

If you can imagine a box that's a little over 3 feet long on all sides,

it'd take a ton of water to fill it up.

So as these aquifers get drained, it takes more and more energy to raise

that water to the surface from deeper depths.

This is a very big concern in some parts of the world.

Much more so than the United States.

Which is why conflict could be a foregone conclusion with

water.

Half of the energy used in large parts of India now is spent extracting

water from pipes that have to run way down beneath the surface for

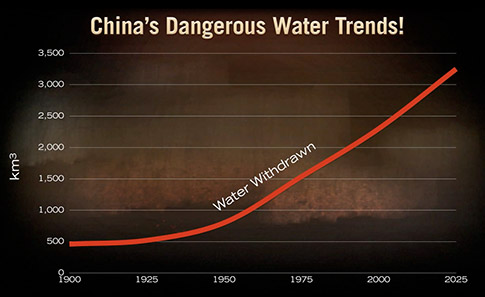

irrigation.

China's water use over the last 100 years is a very aggressive

exponential growth curve in itself.

But they aren't alone.

Pakistan, Mexico, the Middle East, and North Africa are all working off

of borrowed time with their water supplies.

Some of those places aren't exactly a model in stability.

Now here's something most people probably don't think of.

Over the years the United States has produced about 10% of the world's

wheat, but we are the number one exporter of it.

Here's where water plays a big role...

It takes 1,000 tons of water to harvest one ton of wheat.

And that water is coming from irrigation not rainfall.

So when we are exporting wheat to countries with water issues, what we

are really doing is exporting water.

So if water becomes scarce in parts of the world, that'll hike its

value.

Which will hike food prices.

And that will come back to hit average Americans because everything is

priced on world availability, not just how much of it we have inside our

borders.

Dr. Kent Moors:

Water scarcity also creates a massive energy security issue.

Nuclear and coal power plants use large amounts of water to harness

energy.

Who's big in nuclear and coal?

China.

So if you can't easily get the water, you create a situation where energy

becomes even costlier.

And water becomes more valuable than oil.

In fact, half of the water consumed in the United States isn't consumed

by people.

But by electrical power plants.

Keith Fitz-Gerald:

Okay, I think we've made our case for a peak environment scenario, which

is directly tied to our peak energy predicament.

I think we can talk about that final E.

Continuing to Build the Case...

John Daly:

So let's continue to put the pieces of this Pyramid Scheme puzzle

together.

By now you can see it's spreading out far and wide.

World population took from the beginning of time until 1804 to reach 1

billion people.

208 years later we're sitting at 7 billion.

That's exponential growth.

And it has had an impact on the total scope of this Pyramid Scheme

theory.

With our first E – I think the team made the compelling case that

unsustainable, exponential growth patterns show the days of easy energy are

behind us.

Looking solely at oil, we can see it's a poster child for exponential

growth.

Unfortunately, the process of extracting oil is becoming harder and

harder, because the easy stuff is no longer there.

Oil's worsening EROEI ratio is its own example of exponential

growth.

Now, while there are some long-term opportunities, either the technology,

or infrastructure, or some combination of factors isn't quite there yet for us

to be able to quickly transition into a post-oil world.

At least, not before we feel the effects of crippling price hikes in

oil.

So that means we cannot continue to experience exponential growth with

our energy system.

Well, that domino falling crashes into our second E, the

environment.

Our food consumption rates have been rising even faster than our

population.

And we've been fortunate, for a long time, to lean on technological

advances to increase the productivity we've gotten from smaller and smaller

amounts of farmland...

From fewer and fewer farmers.

But less easy energy will make it harder to feed the masses.

And it certainly will make it more expensive.

But expensive food and, possibly, American food shortages are only one

part of that second E.

We are seeing dangerous and unsustainable exponential growth patterns all

over the environment.

Especially with our water needs.

So what happens when you have Peak Energy and Environment situations

crash straight into an American and global economy that is dangerously fragile,

and on the brink of collapse?

You have the makings of an unsustainable Pyramid Scheme.

So that leads us to that final E... the Economy.

The team will investigate the dangers of exponential growth there

next.

But first let me say that in a few minutes we'll send you a 100% free

package that contains all of the proof and findings from our

investigation...

This package includes an eye-opening book with information that has never

been released to the public before today.

And you'll be sent time-sensitive reports that will reveal the steps to

take to protect you and your family's investments, wealth, and way of life, in

the days, months, and years ahead.

It's imperative you get your hands on this information.

So make sure you stay with us to the end of this broadcast.

Part V: The Peak Economy Crisis

Present at Investigation: Chris Martenson, Keith

Fitz-Gerald, and Dr. Kent Moors

Location: Congress, Washington D.C.

Time: Tuesday Afternoon

Location: Congress, Washington D.C.

Time: Tuesday Afternoon

Keith Fitz-Gerald:

Here we stand at the epicenter of this Pyramid Scheme.

Congress.

You can trace a good portion of the roots of this massive crisis right

here.

It was our friends inside the beltway who dropped the ball on our energy

policy.

They're the ones who refused to create an atmosphere that promoted

innovation and the technological advances that could help us curb these

exponential growth issues in our environment.

And they sure as hell are the prime crooks behind that top E in our

Pyramid Scheme, the Economy.

America is the biggest economy in the world, and it's showing a similar

exponential growth curve, to everything else we've investigated

today.

Side Interview with Chris Martenson:

The Final 5% Before We Drown?

Chris

Martenson:

Exponential growth is a complicated

idea.

And when you first hear it, it's role

in this Pyramid Scheme theory may not click right away.

That's why, when I'm presenting my

findings, doesn't matter if I'm meeting with the United Nations or a group of

Americans...

I always use the same scenario to help

clarify this situation.

And it applies perfectly when you look

at our economy.

Imagine somebody is handcuffed to the

top bleacher in Yankee Stadium.

And now imagine Yankee Stadium is

watertight.

So now suppose somebody takes an

eyedropper out to the very center of the stadium.

And that person lets one drop of water

come out of the eye-dropper.

And then, let's imagine that amount

doubles the next minute and every minute that follows.

So how long before that person who is

handcuffed at the very top of Yankee Stadium drowns?

It's only 50 minutes.

So here's the really important

question.

At what point is that stadium still

93% empty?

45 minutes.

It's those last 5 minutes where most

of the exponential growth kicks in, the dangers present themselves, and chaos

breaks out.

I strongly believe that we are well

into those final 5 minutes with the 3 Es – energy, the environment, and the

economy.

And since they are all interconnected,

the Pyramid Scheme will soon come crashing down.

You just need to know what that means

and what steps to take with your finances, investments, and day-to-day life to

prepare for it.

Chris Martenson:

When you break it down, to its simplest form, our economic system is

based on an absurd scenario.

John Smith goes into a bank and deposits $1,000.

The bank turns around and lends $900 of it out.

So that $900 makes its way into another bank which loans $810 of it

out.

And so on.

Because banks can legally lend up to 90% of their deposits right back

out.

After a little while that $1,000 in real money, has turned into $10,000

in fake money because of it being loaned into existence.

This is how banks operate, the Fed operates. Every financial institution

on the planet operates in this same way.

And what nobody talks about is the impact this is having on our Total

Credit Market debt.

In the mid 1940s our total credit market debt sat at around $351 billion

dollars.

And our GDP was $223 billion.

So you had a total credit market debt that was 158% higher than the

GDP.

That was the high mark of that ratio for about 30 years.

And we had World War II to fight back then to inflate it.

But around the mid-1970s our total credit market debt began to rise

rapidly.

Starting in 1970 it took seven years to double.

Then another seven to do it again.

Then five years to double it again after that.

We had a little bit of a slowdown in the late eighties and 90s, and it

took ten years for the next doubling.

But then it only took eight years to double again.

And it's moving much faster than our GDP is growing.

Where we were sitting at a total credit market debt that was 158% larger

than our GDP in the early 1940s...

By 2011 that figure was 357%.

Right now it represents about $691,000 for a family of four in

America.

It's unfathomable.

Now, in order for the twenty-teens to economically resemble any of the

past four decades, we might reasonably speculate that credit market debt would

have to double again, to over $104 trillion.

What about the 2020s?

Are we going to be able to maintain exponential growth for our credit

market debt to hit $208 trillion?

Dr. Kent Moors:

Of course not.

At least not if a dollar is still worth anything resembling a dollar in

today's terms.

Which it won't be.

It's going to take a lot of energy, a lot of environmental factors, and a

lot more gambling in our economy, to give us even a lottery ticket's chance of

continuing this exponential growth.

This pyramid scheme is completely unsustainable.

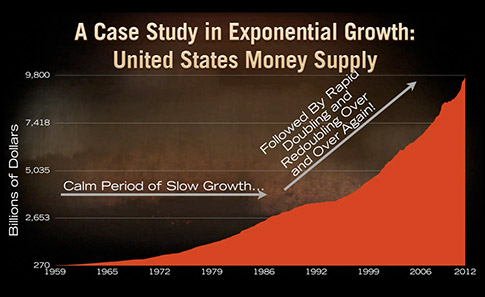

Keith Fitz-Gerald:

Not to mention while we were busy loaning money into existence, we were

also printing a great deal of it.

All while our debt surged to astronomical levels...

Eventually, foreign countries are not going to trust that investing in

America is a safe bet.

To this point, we've been fortunate in some respects that the European

Crisis has made us the best looking horse at the glue factory.

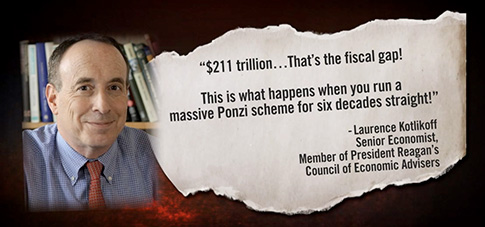

Dr. Kent Moors:

Of course the Fed really likes to just focus on the debt that's on the

books.

If you look at the total net liabilities figure, you'll see we've got a

much bigger problem on our hands than just our Federal debt tab.

And that's setting us up for a situation worse than we've seen in Greece

and across Europe.

This is exactly what happens when you have an economy that is built on

the same model as a Pyramid Scheme.

One that requires you to falsely believe in the sustainability of loaning

money into existence.

Keith Fitz-Gerald:

What we're seeing with the austerity measures in Greece and the

deleveraging with banks, is a pattern that is going to keep reoccurring for the

next 10-20 years.

There's no way around it with all the excessive debt in this

world.

Plus, there's an estimated $600 trillion to $1.4 quadrillion floating

around right now in the global derivatives market.

And a good chunk of that is tied directly to American banks.

So the unsustainability of the American and European economic systems is

quite clear and very real.

These idiots inside the Washington Beltway and their cohorts in Europe do

not understand the realities of the situation.

But when this fiscal nightmare, this Pyramid Scheme, they've created over

the past few decades, runs into these energy and environment issues we've

discussed, it's going to be bedlam.

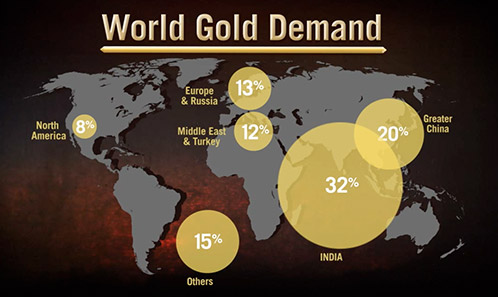

The next round of global superpowers knows this.

It's why both their governments and private citizens are demanding more

and more gold.

Gold is a great barometer for what the world thinks of our economy and

our dollar.

And the clear message they are sending is that they have no faith in us

over the long haul.

Gentlemen, we could spend weeks debating and analyzing more dangerous

exponential growth patterns in our Pyramid Scheme theory.

We've just scratched the surface.

But I think we should now focus on what's going to happen exactly when

this Pyramid Scheme collapses.

What that means for our futures.

And, more importantly, how people should go about preparing their

finances and lives for it.

Because even as scary as this situation is, there are still unprecedented

opportunities out there that not only allow for protection, but also immense

profit potential.

The Team Has Made Their Case...

John Daly:

As I mentioned before, much of what you've just seen has been presented

to governments around the world and the United Nations.

They've shared their findings with them, and now Chris, Keith, and Kent

have come together to bring their findings to you.

You're the one who will feel the impact.

So you need to know what all of this means for you and your family's

well-being.

They've given you all of the proof for what has happened in the

past.

And what is happening now.

But what comes next?

And will you be prepared for it?

We'll discuss that shortly.

I also want you to remind you to stay with us to the very end of this

broadcast.

Because, in a few minutes, I will give you an opportunity to receive a

100% free package that contains all of the proof we've discussed today,

including an eye-opening book that documents what the future may hold for

us.

And you'll also receive a collection of highly sensitive reports critical

for maintaining and growing your wealth in an uncertain future.

That's coming up ahead.

But let's get the closing thoughts of each of the experts you've met

today.

This way you can get a clear picture of what the future holds and what

you need to do next to prepare for the coming crash of the Pyramid

Scheme.

What Comes Next?

And How Can You Stay Safe?

Chris, Keith, Kent –

The next 20 years will be unlike anything we've ever seen in the history

of the world.

And those who aren't ready for what's coming will definitely look upon it

as a catastrophe.

Nobody can talk, with absolute certainties, about what lies ahead in our

path.

But we can definitely make some assumptions based on the

evidence.

The exponential growth that has occurred with our energy, environmental,

and economic systems has reached a point of no return.

It's not about running out of oil.

Or food and water.

It's about not being able to keep up with the demands of

society.

And the dangerous economic constraints that will be put on our country

and the world.

When these factors are combined with an American and global economy

that's already on the verge of a meltdown, it's apparent that, while we may be

able to delay the date this pyramid scheme crashes, the only unknowns at this

point are when will that massive crash occur?

How severe will the outcome be?

And what is the best course of action for you to take in order to prepare

and stay safe.

The first E – energy – is the piece of the pyramid scheme that has the

most influence on the severity of the entire situation.

Because when we reach the point where oil can't fall below $150 a

barrel...

Or $200 a barrel, say in 2013.

When we hit that mark, it's going to cause a ripple effect that weakens

those other two Es tremendously.

Because the bedrock of our society is cheap and easy energy.

When that illusion gives way to the reality that there are no quick

fixes, regardless of what politicians like to say...

The aftermath will go way beyond the $10-a-gallon gasoline we'll be

paying in the near future.

And if we get caught in some period whether it's 10 years, or 20 years,

or longer, where we are stuck between expensive oil and our transition to a mass

integration of natural gas and other alternatives, it's going to stop the

exponential growth patterns in the environment and economy right in their

tracks.

When this pyramid comes crashing down, it will not be smooth.

We soon won't have the easy energy that would allow us to continue to

cheaply extract necessary elements from our environment.

Our food and water is going to become infinitely more expensive in the

years ahead.

It could get so bad that average folks may be spending 30% – even 40% –

of their disposable income on it.

There will be areas of the world that experience increasing hostility

around vital resources like water, farmland, and energy.

The fallout out from this will be truly frightening.

When this pyramid scheme goes, when that last card is placed on the top

of this house of cards, we'll enter a time where the laws of money no longer

apply to individuals.

Where bankruptcies and restructurings involve entire

nation-states.

The world we live in right now has 10-20 times the amount of phony

derivatives floating around than the entire size of our global GDP.

It's unsustainable and impossible to rectify.

Governments and central banks of the world have spent and borrowed us

into oblivion by wasting our tax dollars, hard work, and loyal

citizenship.

They've gambled our futures away.

I expect to see the collapse of sovereign debt occur sometime in the

20-teens.

Up to that point I expect to see absolute desperation on the part of the

Federal Government, as they continue the aggressive money-printing to

accommodate all of the debt we've already built up.

They will punitively tax those who've been responsible with their

money.

I believe we could see America enter into a period of devastating

inflation where the dollar becomes nearly worthless.

Like an exponential growth curve it'll start off slow...

Maybe 8% by 2015.

But then it'll rapidly speed up hitting 10% annually.

Then 25%...

Then 100%...maybe even 600% a year.

Some parts of the country are already starting to prepare for

this.

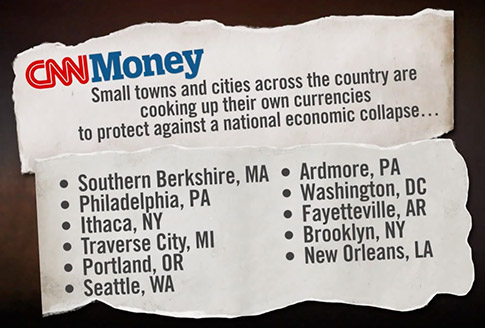

Right now, there are no fewer than 11 places in the United States at

least testing alternatives to the dollar in their local economy on a small

scale.

And there's no wonder why.

A new survey shows that it could soon take a $150,000-a-year household

income for a family to afford basic living expenses, save some money, and have a

little left over for an occasional night out.

It's unbelievable.

That's how weak some experts forecast the U.S. Dollar will soon become in

a world economy.

They don't believe that day is far off.

It's just one reason why the dollar will definitely lose reserve status

at some point in the future.

Due to these harsh economic conditions, soon our governments may not be

able to service the truly needy.

People think entitlements like Social Security and Medicare are

obligations the government has to provide, because Americans paid into the

system...

Those people are wrong. And those programs are bankrupt now.

Washington can take a hatchet to them anytime they like.

People can also forget about the FDIC.

That can only cover a fraction of U.S. bank deposits.

It's a false sense of security.

Plus, state pension payments could get suspended.

It happened in Argentina and Greece.

And it may happen in France, Germany, and here.

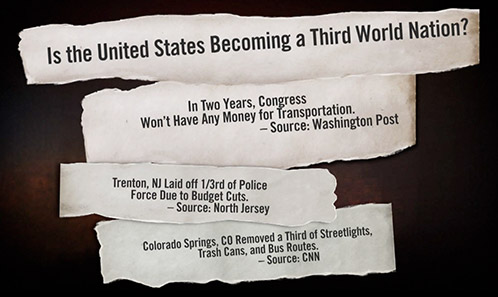

In an extreme scenario, some areas of the country may not have the

revenue to properly fund the police, firemen, and other basic public

services.

Now as everything becomes more strained, society may start to unravel to

some degree.

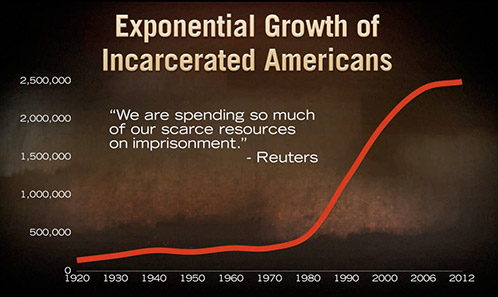

Our rates of incarceration in this country are their own exponential

growth curve.

One that is rising faster than population growth.

This could get much worse as people have to make some tough choices on

how they'll go about surviving in times where basic necessities become nearly

unaffordable.

You've got 1.5 million people in this country living on under $2 a

day.

You've got 46 million Americans below the poverty line.

I believe our safety nets will become nearly obsolete when the Pyramid

Scheme crashes, so you can guarantee crime will rise.

It's not a positive outlook.

People need to avoid falling prey to their own beliefs.

None of these things sound possible.

None of these things sound even remotely probable.

But I believe they are as inevitable as the sun coming up

tomorrow.

The question is: When?

And what is the precise sequence of events that could lead to the

collapse of the pyramid?

But given everything you've just heard, you have to understand that there

are any number of outcomes that could change the severity of this Pyramid

Scheme.

However, you have to be aware of what's possible.

And you also have to have hope.

Keith Fitz-Gerald:

Let me put that in perspective.

In just over the last 100 years, this country has made it through two

World Wars, multiple recessions, a Great Depression, a presidential

assassination, 9/11 and a long list of other difficult times.

We survived it all, and the Dow still returned 22,000%.

This Pyramid Scheme may be terrifying, but it's not the

endgame.

If people want to put their hands over their eyes and think that these