Rating agency decisions, usury..., greed, utter Fraud and Raging Inequality, May Cause Unrest and Violence In America and the Rest of the Western World...and way beyond.!

Raging inequality was largely responsible for the Great Depression and for the current financial crisis.

http://usuryfree.blogspot.com/2011/03/hidden-history-of-money-and-feudal.html

January:

Egyptian, Tunisian and Yemeni protesters all say that inequality is one of the main reasons they're protesting.

However, the U.S. actually has much greater inequality than in any of those countries.

Is there any way that the growing inequality could cause unrest in America or the rest of the Western world?

Initially, the Greek and Spanish riots have grown out of bailouts and other windfalls for the big banks and hedge funds (see this, and this), and austerity for the working stiff. So in a sense, they are about inequality.

Moreover, in February:

Agence France-Press reports today:

The International Monetary Fund stands ready to help riot-torn Egypt rebuild its economy, the IMF chief said Tuesday as he warned governments to tackle unemployment and income inequality or risk war.Forbes reported in February:

Harvard economist Kenneth Rogoff, co-author of a best-selling book on financial crises, “This Time It’s Different,” told Forbes today in an exclusive interview, that the high unemployment rate and high levels of debt in the U.S. will sooner or later trigger serious “social unrest from the income disparities in the U.S.”

The Obama administration has “no clue,” he told me what do about this terrible disparity in the economy that is bound to erupt sooner or later, he feels.

“I don’t understand why people don’t wake up to the crisis they are creating,” he said to me just minutes after appearing at a Council on Foreign Relations round-table on “Currency Wars.”

And in June:

CNN's Jack Cafferty notes that a number of voices are saying that - if our economy continues to deteriorate (which it very well might) - we are likely headed for violence, and civil unrest is a growing certainty.Watch the must-see CNN viewer comments on this issue:

http://revolutionarypolitics.tv/video/viewVideo.php?video_id=15271

Newsweek wrote two weeks ago:

Reality is beginning to break through. Gas and grocery prices are on the rise, home values are down, and vast majorities think the country is on the wrong track. The result is sadness and frustration, but also an inchoate rage more profound than the sign-waving political fury documented during the elections last fall.

***

In search of the earthly toll of this outrage, NEWSWEEK conducted a poll of 600 people, finding vastly more unquiet minds than not. Three out of four people believe the economy is stagnant or getting worse. One in three is uneasy about getting married, starting a family, or being able to buy a home. Most say their relationships have been damaged by economic woes or, perhaps more accurately, the dread and nervousness that accompany them.

Could these emotions escalate into revolt?

Why Are People So Angry?

Well, as the Newsweek article points out:

Corporate earnings have soared to an all-time high. Wall Street is gaudy and confident again. But the heyday hasn’t come for millions of Americans. Unemployment hovers near 9 percent, and the only jobs that truly abound, according to Labor Department data, come with name tags, hairnets, and funny hats (rather than high wages, great benefits, and long-term security). The American Dream is about having the means to build a better life for the next generation. But as President Obama acknowledged at a town-hall meeting in May, “a lot of folks aren’t feeling that [possibility] anymore.”By way of background, America - like most nations around the world - decided to bail out their big banks instead of taking the necessary steps to stabilize their economies . As such, they all transferred massive debts (from fraudulent and stupid gambling activities) from the balance sheets of the banks to the balance sheets of the country.

The nations have then run their printing presses nonstop in an effort to inflate their way out of their debt crises, even though that effort is doomed to failure from the get-go.

Quantitative easing by the Federal Reserve is obviously causing food prices to skyrocket worldwide (and see this, this and this).

But the fact is that every country in the world that can print money - i.e. which is not locked into a multi-country currency agreement like the Euro - has been printing massive quantities of money. .

Moreover, the austerity measures which governments worldwide are imposing to try to plug their gaping deficits (created by throwing trillions at their banks) are causing people world-wide to push back.

As 2009 and again in December of that year:

Numerous high-level officials and experts warn that the economic crisis could lead to unrest world-wide - even in developed countries:

- Today, Moody's warned that future tax rises and spending cuts could trigger social unrest in a range of countries from the developing to the developed world, that in the coming years, evidence of social unrest and public tension may become just as important signs of whether a country will be able to adapt as traditional economic metrics, that a fiscal crisis remains a possibility for a leading economy, and that 2010 would be a “tumultuous year for sovereign debt issuers”.

- The U.S. Army War College warned in 2008 November warned in a monograph [click on Policypointers’ pdf link to see the report] titled “Known Unknowns: Unconventional ‘Strategic Shocks’ in Defense Strategy Development” of crash-induced unrest:

The military must be prepared, the document warned, for a “violent, strategic dislocation inside the United States,” which could be provoked by “unforeseen economic collapse,” “purposeful domestic resistance,” “pervasive public health emergencies” or “loss of functioning political and legal order.” The “widespread civil violence,” the document said, “would force the defense establishment to reorient priorities in extremis to defend basic domestic order and human security.” “An American government and defense establishment lulled into complacency by a long-secure domestic order would be forced to rapidly divest some or most external security commitments in order to address rapidly expanding human insecurity at home,” it went on. “Under the most extreme circumstances, this might include use of military force against hostile groups inside the United States. Further, DoD [the Department of Defense] would be, by necessity, an essential enabling hub for the continuity of political authority in a multi-state or nationwide civil conflict or disturbance,” the document read.

- Director of National Intelligence Dennis C. Blair said:

"The global economic crisis ... already looms as the most serious one in decades, if not in centuries ... Economic crises increase the risk of regime-threatening instability if they are prolonged for a one- or two-year period," said Blair. "And instability can loosen the fragile hold that many developing countries have on law and order, which can spill out in dangerous ways into the international community."***

"Statistical modeling shows that economic crises increase the risk of regime-threatening instability if they persist over a one-to-two-year period."***

“The crisis has been ongoing for over a year, and economists are divided over whether and when we could hit bottom. Some even fear that the recession could further deepen and reach the level of the Great Depression. Of course, all of us recall the dramatic political consequences wrought by the economic turmoil of the 1920s and 1930s in Europe, the instability, and high levels of violent extremism.”

Blair made it clear that - while unrest was currently only happening in Europe - he was worried this could happen within the United States.

[See also this].

- Former national security director Zbigniew Brzezinski warned "there’s going to be growing conflict between the classes and if people are unemployed and really hurting, hell, there could be even riots."

Others warning of crash-induced unrest include:

- The chairman of the Joint Chiefs of Staff warned the financial crisis is the highest national security concern for the U.S., and warned that the fallout from the crisis could lead to of "greater instability".

Unemployment is soaring globally - especially among youth.

- The head of the World Trade Organization

- The head of the International Monetary Fund .

- The head of the World Bank

- Senator Christopher Dodd

- Congressman Ron Paul (radio interview on March 6, 2009)

- Britain's MI5 security agency

- Leading economic historian Niall Ferguson

- Leading economist Marc Faber and billionaire investor Jim Rogers

- Leading economist Nouriel Roubini

- Leading economist John Williams

- Top trend researcher Gerald Calente

- European think tank Leap2020

And the sense of outrage at the injustice of the rich getting richer while the poor get poorer is also a growing global trend.

Countries worldwide told their people that bailout out the giant banks was necessary to save the economy. But they haven't delivered, and the "Main Streets" of the world have suffered.

As former American senator (and consummate insider) Chris Dodd said in 2008:

If it turns out that [the banks] are hoarding, you’ll have a revolution on your hands. People will be so livid and furious that their tax money is going to line their pockets instead of doing the right thing. There will be hell to pay.Of course, the big banks are hoarding, and refusing to lend to Main Street. In fact, they admitted back in 2008 that they would. And the same is playing out globally.

As in February:

***No wonder former U.S. National Security Adviser Zbigniew Brzezinski ... warned the Council on Foreign Relations that:

For the first time in human history almost all of humanity is politically activated, politically conscious and politically interactive. There are only a few pockets of humanity left in the remotest corners of the world that are not politically alert and engaged with the political turmoil and stirrings that are so widespread today around the world.

***

America needs to face squarely a centrally important new global reality: that the world's population is experiencing a political awakening unprecedented in scope and intensity, with the result that the politics of populism are transforming the politics of power. The need to respond to that massive phenomenon poses to the uniquely sovereign America an historic dilemma: What should be the central definition of America's global role?[T]he central challenge of our time is posed not by global terrorism, but rather by the intensifying turbulence caused by the phenomenon of global political awakening. That awakening is socially massive and politically radicalizing.It is no overstatement to assert that now in the 21st century the population of much of the developing world is politically stirring and in many places seething with unrest. It is a population acutely conscious of social injustice to an unprecedented degree, and often resentful of its perceived lack of political dignity. The nearly universal access to radio, television and increasingly the Internet is creating a community of shared perceptions and envy that can be galvanized and channeled by demagogic political or religious passions. These energies transcend sovereign borders and pose a challenge both to existing states as well as to the existing global hierarchy, on top of which America still perches.Watch an excerpt:

***

That turmoil is the product of the political awakening, the fact that today vast masses of the world are not politically neutered, as they have been throughout history. They have political consciousness.

***

Politically awakened mankind craves political dignity, which democracy can enhance, but political dignity also encompasses ethnic or national self-determination, religious self-definition, and human and social rights, all in a world now acutely aware of economic, racial and ethnic inequities. The quest for political dignity, especially through national self-determination and social transformation, is part of the pulse of self-assertion by the world's underprivileged

***

We live in an age in which mankind writ large is becoming politically conscious and politically activated to an unprecedented degree, and it is this condition which is producing a great deal of international turmoil.

That turmoil is the product of the political awakening, the fact that today vast masses of the world are not politically neutered, as they have been throughout history. They have political consciousness.

Powerful words from Ron Paul:

"Every Time the Federal Reserve Engages In More Quantitative Easing and Devalues the Dollar, It Is Defaulting on the American People by Eroding their Purchasing Power and Inflating their Savings Away. The Dollar Has Lost Nearly 50% of Its Value Against Gold Since 2008 ... This Is a Default. Just Because It Is a Default On The People and Not The Banks and Foreign Holders of Our Debt Does Not Mean It Doesn't Count".

Politicians need to understand that without real change default is inevitable. In fact, default happens every day through monetary policy tricks. Every time the Federal Reserve engages in more quantitative easing and devalues the dollar, it is defaulting on the American people by eroding their purchasing power and inflating their savings away. The dollar has lost nearly 50% of its value against gold since 2008. The Fed claims inflation is 2% or less over the past few years; however economists who compile alternate data show a 9% inflation rate if calculated more traditionally. Alarmingly, the administration is talking about changing the methodology of the CPI calculation yet again to hide the damage of the government's policies. Changing the CPI will also enable the government to avoid giving seniors a COLA (cost of living adjustment) on their social security checks, and raise taxes via the hidden means of "bracket creep." This is a default. Just because it is a default on the people and not the banks and foreign holders of our debt does not mean it doesn't count.

***

Perhaps the most abhorrent bit of chicanery has been the threat that if a deal is not reached to increase the debt by August 2nd, social security checks may not go out. In reality, the Chief Actuary of Social Security confirmed last week that current Social Security tax receipts are more than enough to cover current outlays. The only reason those checks would not go out would be if the administration decided to spend those designated funds elsewhere. It is very telling that the administration would rather frighten seniors dependent on social security checks than alarm their big banking friends, who have already received $5.3 trillion in bailouts, stimulus and quantitative easing. This instance of trying to blackmail Congress ....

***http://http://www.mongabay.com/images/commodities/charts/chart-steel_rebar.html

We need to stop expensive bombing campaigns against people on the other side of the globe and bring our troops home. We need to stop allowing secretive banking cartels to endlessly enslave us through monetary policy trickery. And we need to drastically rethink government's role in our lives so we can get it out of the way and get back to work.

Remember, quantitative easing doesn't help anyone but the biggest Wall Street companies (and see this, this and this).

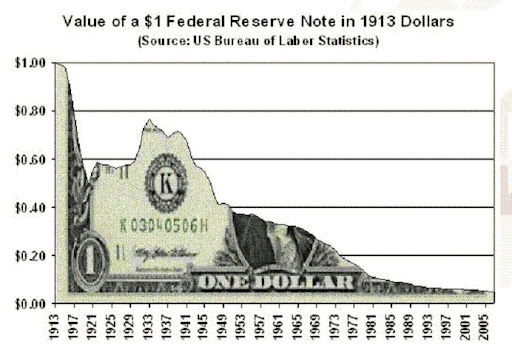

And while "the dollar has lost nearly 50% of its value against gold since 2008", it got creamed by Federal Reserve policies before then as well. As of last year:

Here's a chart of the trade weighted US Dollar from 1973-2009.

And here's a bonus chart showing the decline in the dollar's purchasing power from 1913 to 2005:

Indeed, Ben Bernanke has previously admitted that inflation is a tax on the American people:

Paul Krugman writes today in the New York Times.

Ever since the current economic crisis began, it has seemed that five words sum up the central principle of United States financial policy: go easy on the bankers.

***

Officials are pushing for a settlement with mortgage companies that, reports Shahien Nasiripour of The Huffington Post, “would broadly absolve the firms of wrongdoing in exchange for penalties reaching $30 billion and assurances that the firms will adhere to better practices.”

Why the rush to settle? As far as I can tell, there are two principal arguments being made for letting the banks off easy. The first is the claim that resolving the mortgage mess quickly is the key to getting the housing market back on its feet. The second, less explicitly stated, is the claim that getting tough with the banks would undermine broader prospects for recovery.

Neither of these arguments makes much sense.

The claim that removing the legal cloud over foreclosure would help the housing market — in particular, that it would help support housing prices — leaves me scratching my head. It would just accelerate foreclosures, and if more families were evicted from their homes, that would mean more homes offered for sale — an increase in supply. An increase in the supply of a good usually pushes that good’s price down, not up. Why should the effect on housing go the opposite way?

You might point to the mortgage relief that would supposedly be extracted as part of the settlement. But if mortgage relief is that crucial, why isn’t the administration making a major push to reinvigorate its own Home Affordable Modification Program, which has spent only a small fraction of its money? Or if making that program actually work is hard, why should we believe that any program instituted as part of a mortgage-abuse settlement would work any better?

Sorry, but the case that letting banks off the hook would help the housing market just doesn’t hold together.

What about the argument that getting tough with the banks would threaten the overall economy? Here the question is: What’s holding the economy back?

It’s not the state of the banks. It’s true that fears about bank solvency disrupted financial markets in late 2008 and early 2009. But those markets have long since returned to normal, in large part because everyone now knows that banks will be bailed out if they get in trouble.

The big drag on the economy now is the overhang of household debt, largely created by the $5.6 trillion in mortgage debt that households took on during the bubble years. Serious mortgage relief could make a dent in that problem; a $30 billion settlement from the banks, even if it proved more effective than the government’s modification program, would not.

So when officials tell you that we must rush to settle with the banks for the sake of the economy, don’t believe them. We should do this right, and hold bankers accountable for their actions.

Moody's and Standard & Poors are the largest, best known rating agencies which are endorsed by the U.S. government (technically known as Nationally Recognized Statistical Rating Organization (NRSRO). Fitch is another well-known NRSRO.

But there are actually 10 NRSRO's:

- Kroll Bond Rating Agency

- Moody's Investor Service

- Standard & Poor's

- Fitch Ratings

- A. M. Best Company

- Dominion Bond Rating Service, Ltd

- Japan Credit Rating Agency, Ltd.

- R&I Inc. (Rating and Investment Information, Inc.)

- Egan-Jones Rating Company

- Realpoint LLC

Egan-Jones Downgrades U.S.

Standard & Poors has recently threatened to downgrade U.S. credit even if there is no debt default....

As Zero Hedge notes, Egan-Jones has just downgraded U.S. credit, for reasons other than the debt ceiling debate:

The one truly independent and capable NRSRO, Egan-Jones, downgraded the US from AAA to AA+ over the weekend.

From the release:

Real GDP increased at an annualized rate of 4.0% in Q1 2011, following an increase of 3.5% rise in the prior quarter. Personal consumption expenditures, exports, and nonresidential fixed investment contributed positively to growth during the quarter. Meanwhile, imports rose sharply. In the March 2011 quarter, trade in goods and services resulted in a deficit of $562B, many because of the high price of petroleum. However, the major factor driving credit quality is the relatively high level of debt and the difficulty in significantly cutting spending. We are taking a negative action not based on the delay in raising the debt ceiling but rather our concern about the high level of debt to GDP in excess of 100% compared to Canada's 35%. Nonetheless, since the US's debt is denominated in dollars, a hard default is unlikely.

And while there is much more in the full report (mind you nothing of it is surprising to anyone), the post script is spot on:

Nota Bene [Latin for "Note Well"]

History has proven that defaults on domestic public debt do occur. In fact, seventy out of three hundred twenty defaults since 1800 have been on domestic public debt (1). Egan-Jones does not view a country's ability to print its own currency as a guarantee against default. Additionally, Egan-Jones generally views cases of excessive currency devaluation as a de facto default.

While the mainstream media will not pay much attention to Egan-Jones, the downgrade is another indication that the debt ceiling debate is a melodrama distracting from the deeper issues.

The Great Global Debt Depression: It’s All Greek To Me

By Andrew Gavin Marshall

Introduction

In late June of 2011, the Greek government passed another round of austerity measures, ostensibly aimed at getting Greece “back on track” to economic progress, but in reality, implementing a systematic program of ‘social genocide’ in the name of servicing an endless and illegitimate debt to foreign banks. Right on cue, protests and riots broke out in Athens against the draconian measures, and the state moved in to do what states do best: oppress the people with riot police, tear gas and bashing batons, leaving roughly 300 people injured.

Is Greece simply a case of a country full of lazy people who spent beyond their means and are now paying for their own decadence? Or, is there something much larger at stake – and at play – here? Greece is, in fact, a microcosm of the global economy: mired in excessive debt, economically ruined, increasingly politically repressive and socially explosive. This report takes a look at the case of the Greek debt crisis specifically, and places it within a wider global context. The conclusion is clear: what happens in Greece will happen here.

This report examines the Greek crisis, as well as the larger global economic crisis, including the origins of the housing bubble, the bailouts, the banks, and the major actors and institutions which will come to dominate the stage over the next decade in what will play out as ‘The Great Global Debt Depression.’.

http://www.goldismoney2.com/showthread.php?524-Venetian-Bankers-and-the-Dark-Ages&s=db15cd204b537abf9fa6c5dfee19bfaf

No comments:

Post a Comment